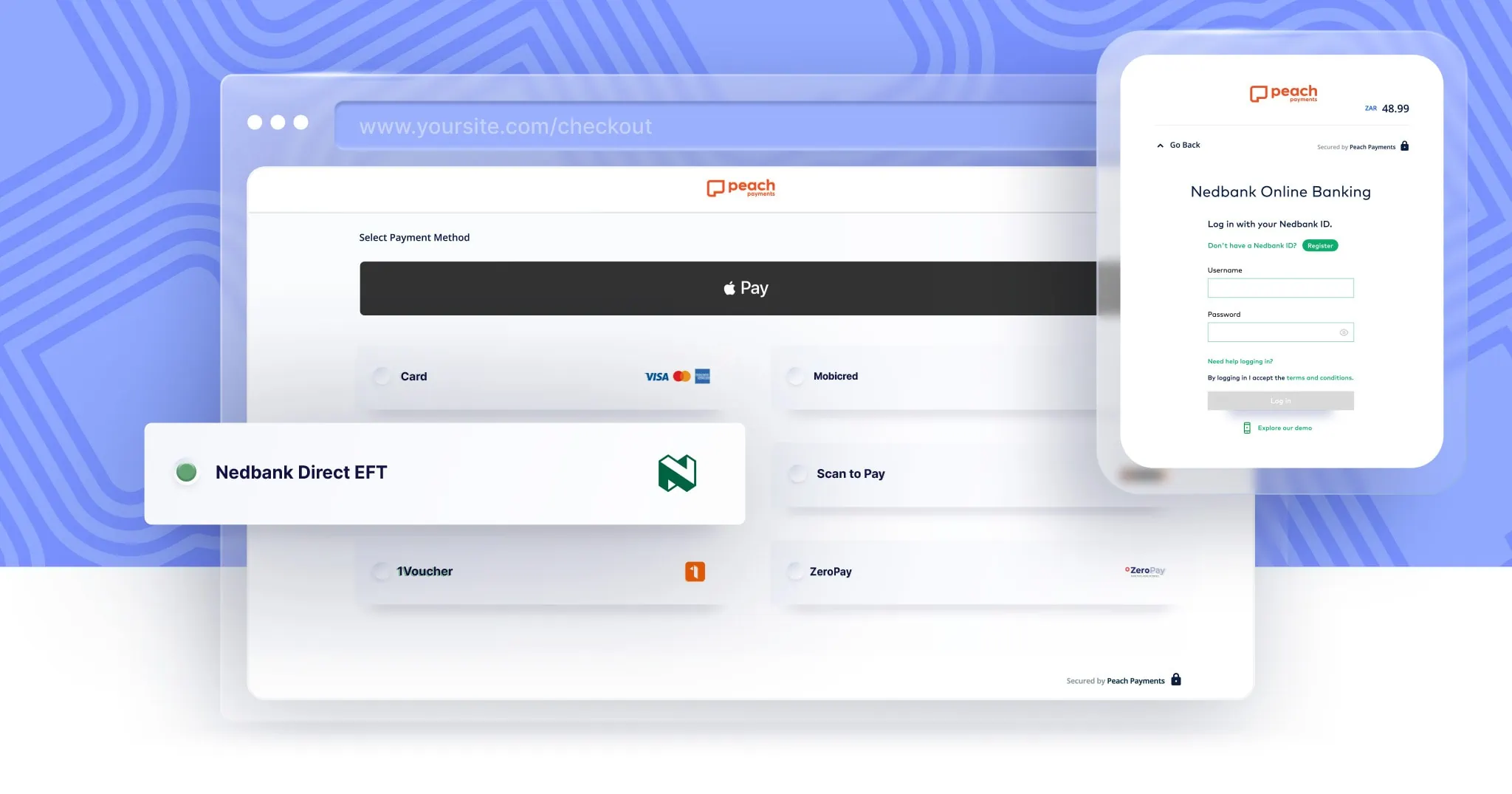

Nedbank Direct EFT now available through Peach Payments

Nedbank Direct EFT is now available as a payment option on ecommerce websites that use Peach Payments, a leading South African payment gateway.

Read More

Peach Payments is paving the way for a transformative 2025. From Pay by Bank to Embedded Checkout, explore how we revolutionised payments in 2024

As we enter 2025, we’re taking a moment to reflect on 2024 - a year filled with exciting advancements. Our team launched dozens of new features, all laser-focused on meeting merchant needs and making payments smarter, safer, and more efficient.

Here’s a closer look at some standout additions to the Peach Payments ecosystem:

One of our most exciting launches this year was Pay by Bank, a secure, card-free payment option that’s rapidly gaining popularity. Customers can approve payments directly through their banking apps, eliminating the need for sensitive card details. Unlike traditional EFT solutions, which rely on outdated methods like screen-scraping, Pay by Bank leverages cutting-edge technology for maximum security and a seamless experience. With Pay by Bank already accounting for 69% of Peach Payments’ transaction volume, its impact has been transformative.

This year, we expanded our digital wallet offerings by integrating Apple Pay, Google Pay, and Samsung Pay across both hosted and embedded checkouts. With digital wallets showing 20% higher conversion rates than traditional methods, they’re proving to be an essential tool for merchants looking to drive growth.

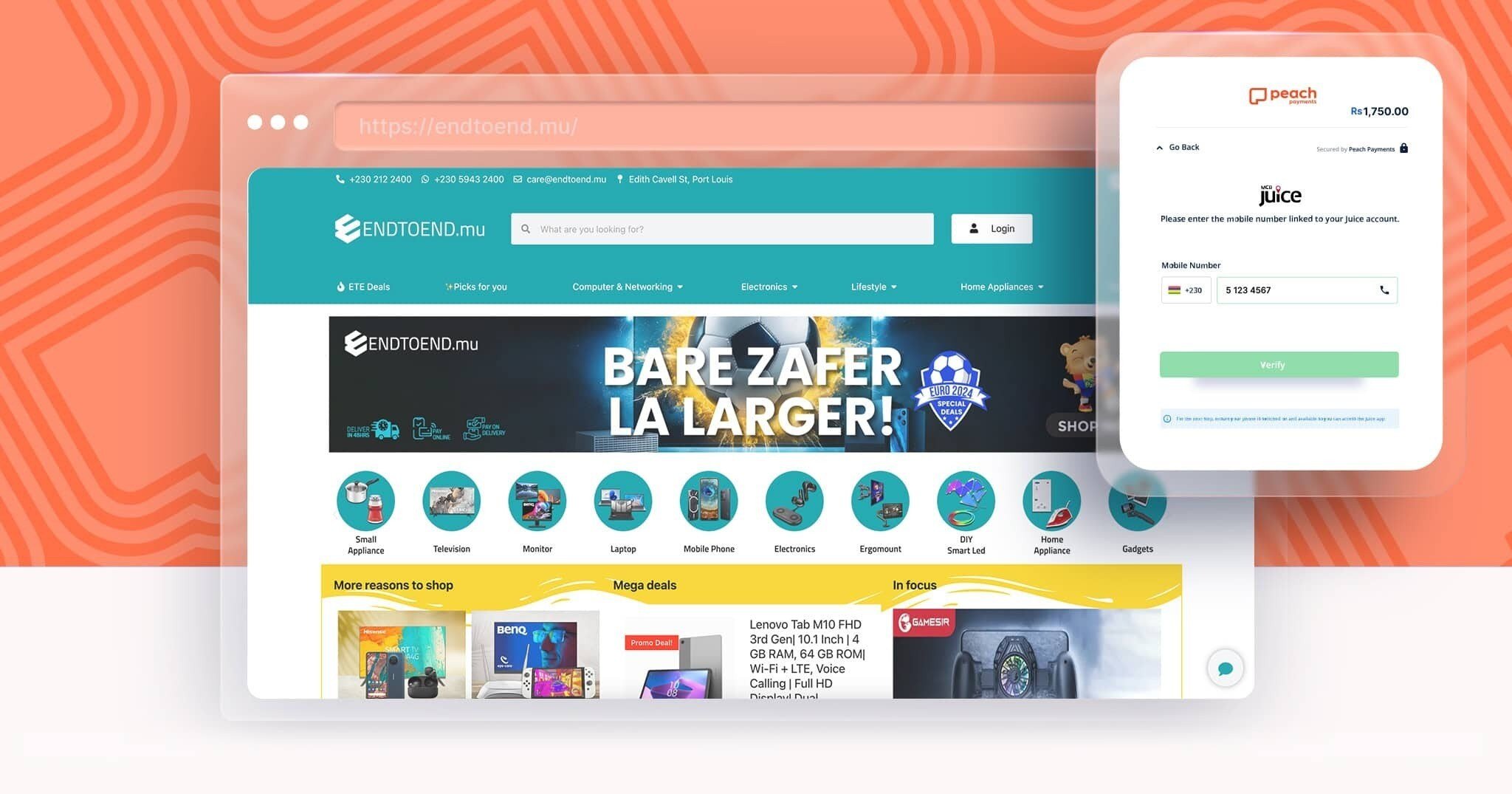

We extended our reach in Mauritius by introducing MCB Juice, a widely-used payment method that allows customers to make purchases via their mobile numbers linked to MCB accounts. With over 420,000 active users, this addition enables merchants to connect with a growing audience in the region.

In 2024, we added RCS Cards, South Africa’s leading store card, to our ecosystem. Offering up to 55 days of interest-free credit, RCS cards enhance customer flexibility while driving merchant sales and loyalty.

The popularity of Buy Now, Pay Later (BNPL) surged this year, especially during quieter retail periods like January. To meet demand, we launched Float and Happy Pay, two new BNPL options with fixed settlement terms and zero interest. These solutions make purchases more accessible to customers and empower merchants to cater to a wider audience.

Recognising that trust is key to reducing cart abandonment, we launched Embedded Checkout in 2024. This feature allows customers to complete transactions directly on a merchant’s website or app, avoiding redirections to external pages. With customisable designs and support for alternative payment methods, Embedded Checkout offers a seamless, branded, and trusted payment experience.

For businesses without websites, we introduced Payment Pages—a simple, shareable link that directs customers to a secure hosted payment page. Whether through WhatsApp, Facebook, or X, this versatile solution allows merchants to collect payments effortlessly, wherever they engage with their customers.

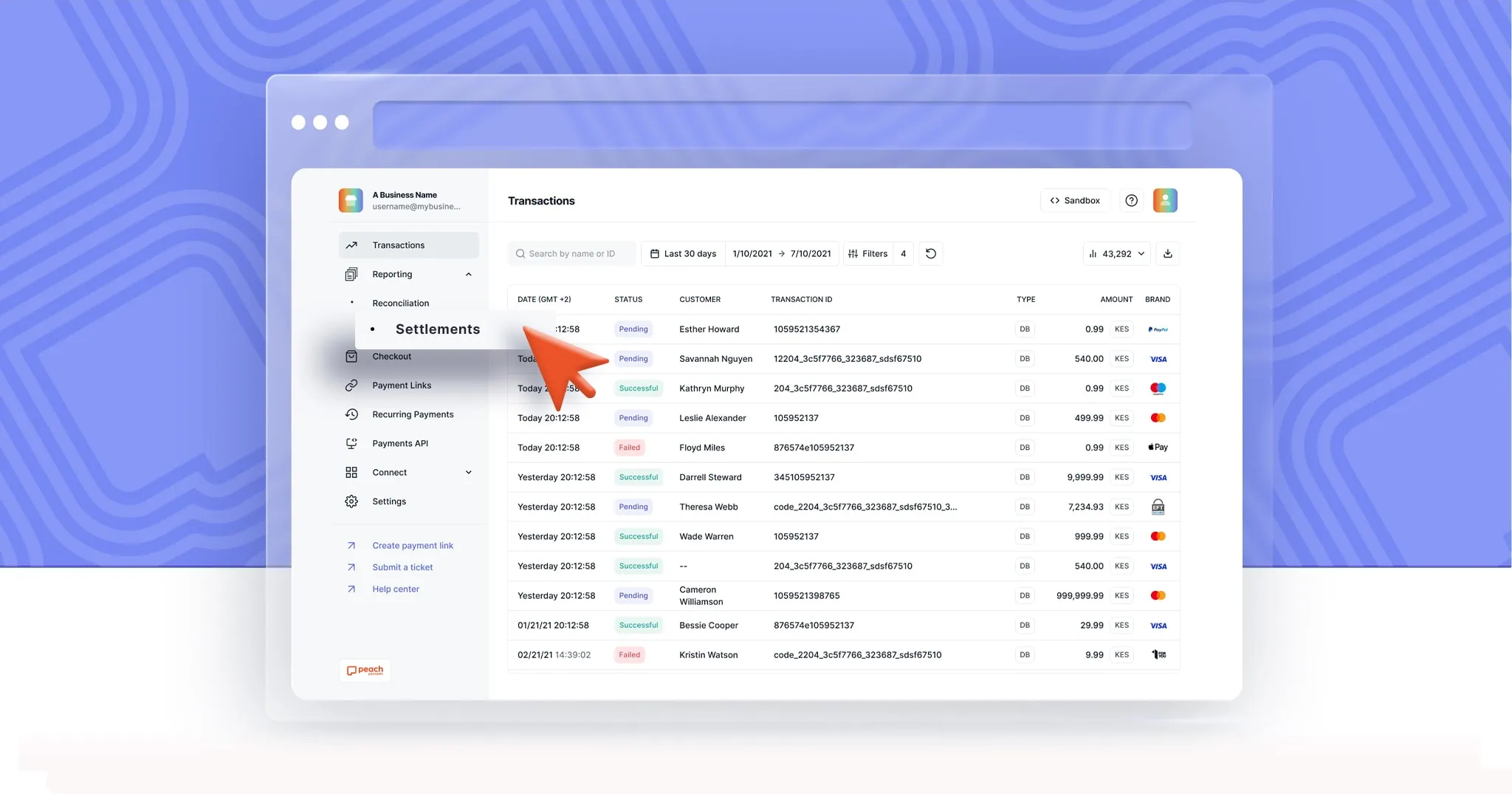

To modernise transaction reconciliation, we launched the Recon API, designed for enterprise merchants managing high volumes. This solution replaces manual exports and outdated SFTP processes with real-time data manipulation, improving accuracy and scalability.

Our new Real-Time Payouts feature enables businesses to automate fund disbursement in South Africa via a single API. By reducing manual intervention and streamlining processes, this feature enhances operational efficiency.

Adding new payment methods is now effortless with Payment Method Activations in our dashboard. Merchants can enable payment methods with just a few clicks while gaining real-time insights to optimise performance.

Managing complex organisational structures is now simpler with Organisation Hierarchy, which provides a consolidated view of transaction data across business units. This feature helps merchants streamline operations and gain detailed insights into their performance.

With 93% of retail transactions still happening in physical stores, we introduced a powerful in-store solution to bridge the gap between online and offline sales. Our two new card machines create a seamless omnichannel experience by integrating with a single dashboard that consolidates all transactions. Custom apps can also be installed for industry-specific needs, offering unmatched flexibility for businesses operating both in-store and online.

As we close a successful 2024, we’re already preparing for an even more transformative 2025. With innovative solutions in the pipeline, Peach Payments will continue to empower merchants and revolutionise the payments landscape across industries.

Thank you for being part of our journey. Stay tuned for more exciting updates!

No spam. Just the latest news, ecommerce tips and tricks to help you scale your business.

Nedbank Direct EFT is now available as a payment option on ecommerce websites that use Peach Payments, a leading South African payment gateway.

Read More

South Africa-based digital payments platform Peach Payments shares weekend results

Read More

Peach Payments' latest innovations and future plans, emphasising customer-centric solutions and trailblazing advancements in the African payments industry.

Read More

Peach Payments' alternative payment method, MCB Juice, has been instrumental in helping Endtoend.mu target a larger audience, making the platform more inclusive and accessible to shoppers from all corners of Mauritius.

Read More

Peach Payments today launches its Black Friday Dashboard live on its website

Read More

Peach Payments is excited to offer daily settlements to all merchants making use of its online payment gateway.

Read More.png)

.png)

.png)

.png)

.png)