Watch how South Africans are buying on Black Friday

Peach Payments today launches its Black Friday Dashboard live on its website

Read More

With credit card and online payments fraud being rife, it is important to know what security measures are being taken between the merchant you are buying from and the payment gateway you are using to buy.

1. Merchants (on their websites or app)

2. Peach Payments (your payment service provider)

1. SSL Certificate

This makes sure that the information transmitted from your browser to the website is encrypted and secured when being sent over the internet. An eCommerce merchant would install this on their platform (website / app ) to help ensure the security of your information.

How to see if a website / app has an SSL security certificate installed :

- HTTPS:// rather than HTTP:// at the beginning of the website link/address

- Padlock icon at the beginning of the URL

2. 3D Secure processing

This makes sure that your bank notifies to verify a transaction, by sending you a One Time Pin (OTP) when you enter your card details and confirm payment for an order or service.

This 3D Secure process is how your bank (issuing bank, eg. ABSA, FNB, Nedbank, Standard Bank etc) lets the website know that you are the owner of the card or account.

3. Protection of Personal Information (POPI)

More information on how merchants protects your personal information is available here

4. Use our "Secured by Peach Payments" logo on your website and checkout

We have all our payment method logos (visa, mastercard, etc) and our "secured by Peach Payments" logo available here for easy download. You can link the "secured by Peach Payments" logo to this article you are reading so your customers learn about all the ways we keep buyers and sellers safe.

What does Peach Payments do to secure my transactions?

Peach Payments processes transactions according to agreements with our acquiring partners, card schemes, PCI compliance, Payment Association Of South Africa and other 3rd parties in the processing chain (More detail on this provided in contract with our merchants) - Please contact your merchant (website or app) for more information on how they implement peach payments services and products on their web or mobile platform.

Read more on what Peach Payments does to make sure your transactions are safe on our merchants websites and apps:

No spam. Just the latest news, ecommerce tips and tricks to help you scale your business.

Peach Payments today launches its Black Friday Dashboard live on its website

Read More

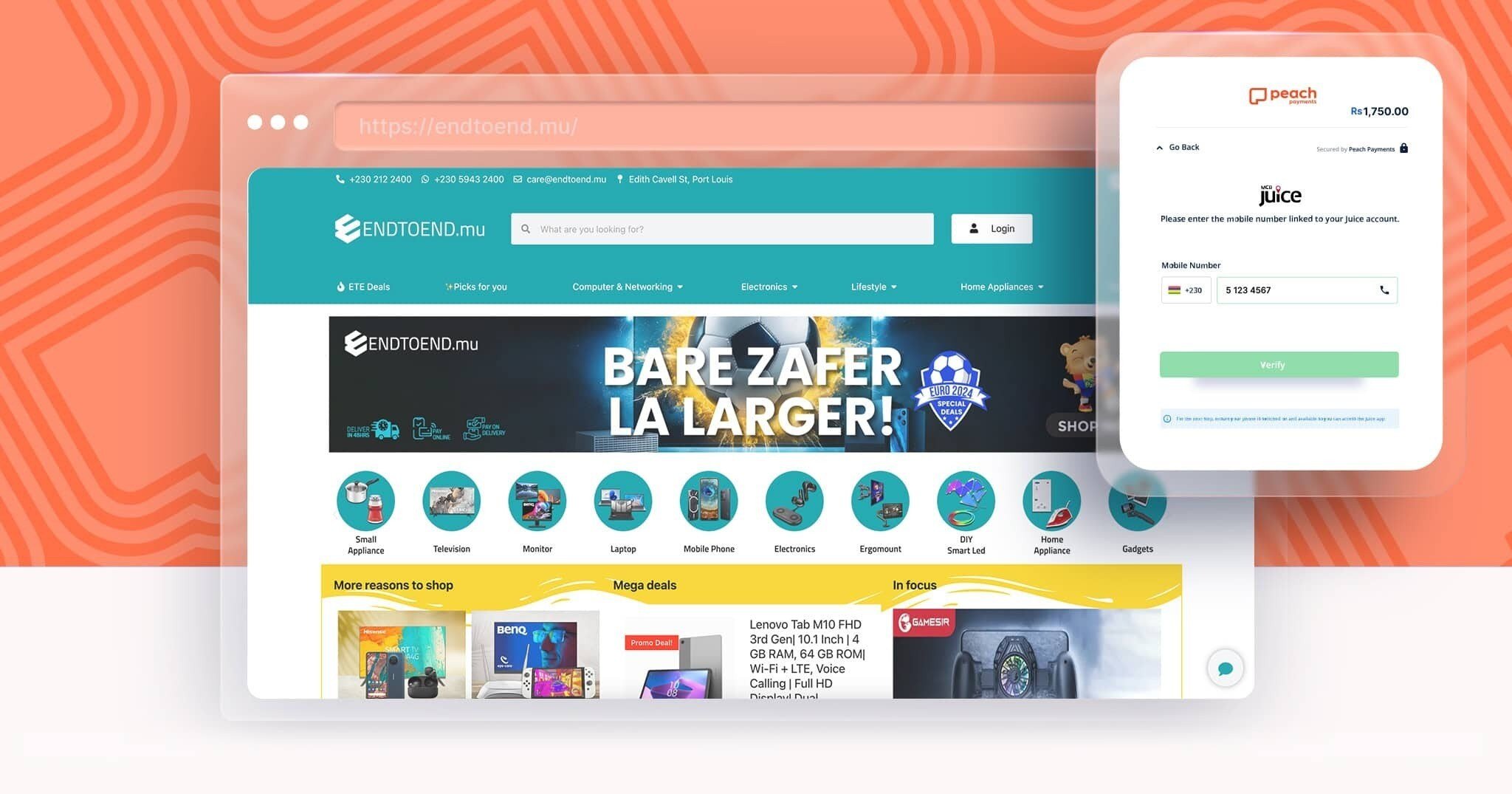

Peach Payments' alternative payment method, MCB Juice, has been instrumental in helping Endtoend.mu target a larger audience, making the platform more inclusive and accessible to shoppers from all corners of Mauritius.

Read More

South Africa-based digital payments platform Peach Payments shares weekend results

Read More

Peach Payments' latest innovations and future plans, emphasising customer-centric solutions and trailblazing advancements in the African payments industry.

Read More

Discover the impactful journey of Peach Payments innovating payment solutions over the past 12 years, and future plans to empower businesses across Africa.

Read More

Everything you need to know about using Peach Payments' payment gateway in high-risk industries, like dropshipping, betting and marketplaces.

Read More.png)

.png)

.png)

.png)

.png)