The Battle for Card Security

How Your Payment Integration Defines Your PCI DSS Scope

Read More

Peach Payments does the heavy lifting, but here's what you need to do

In our last blog, we explored the evolution of payment security and the importance of protecting your entire digital ecosystem. Today, we’re zooming in on the practical steps you need to take as a merchant to ensure you’re aligned with PCI DSS v4.0, the latest iteration of the payment security standard. Spoiler alert: it’s not just about checking boxes; it’s about future-proofing your business against evolving cyber threats.

First things first—compliance starts with understanding which Self-Assessment Questionnaire (SAQ) applies to your payment setup. The form you fill out depends on how you process payments:

Running an eCommerce site means hackers are always knocking at your door. So, how do you keep them out? Start with the basics:

You know that annoying little pop-up reminding you to update your software? Yeah, it’s not just a nuisance—it’s a lifeline. Ensure that your eCommerce platform and CMS are always up-to-date, and don’t neglect those plugins and themes. They’re often the weakest link in your security chain.

The bad guys are getting smarter, which means you need to stay two steps ahead. Set up automated scanning tools to keep an eye out for vulnerabilities 24/7. It’s not enough to just check in periodically—you need to know about issues the moment they arise.

Your payment security isn’t just about what’s happening on your website. If your third-party partners aren’t PCI DSS compliant, their vulnerabilities can become your vulnerabilities. Do your homework, and confirm that they’re meeting the standards, too.

How Peach Payments Supports Your Compliance Journey

Luckily, you don’t have to navigate PCI DSS v4.0 compliance alone. Peach Payments takes much of the heavy lifting off your shoulders.

Securing just the payment form isn't enough anymore. With the rise of e-skimming and other cyber threats, PCI DSS v4.0 requires merchants to secure their entire digital environment. At Peach Payments, we take the hard work out of compliance, ensuring your systems are secure while guiding you through the necessary steps to meet the new requirements.

March 2025 is the deadline for full compliance, so now’s the time to act and lock every door and window of your digital house. We’ll be sharing more insights in the coming months on how Peach Payments helps merchants comply with the new future-dated requirements.

For more details on PCI DSS v4.0, visit the PCI Security Standards website

To learn more about how we protect merchants today, check out our Security at Scale page

No spam. Just the latest news, ecommerce tips and tricks to help you scale your business.

What measures should business owners take to manage risk and fraud with ecommerce.

Read More

What You Need to Know About PCI DSS 4.x

Read More

Peach Payments is paving the way for a transformative 2025. From Pay by Bank to Embedded Checkout, explore how we revolutionised payments in 2024

Read More

With a focus on quality, community, and customer satisfaction, Bloomable stands out as a pioneer in the online marketplace, transforming the way local florists connect with their customers and compete in the digital landscape.

Read More

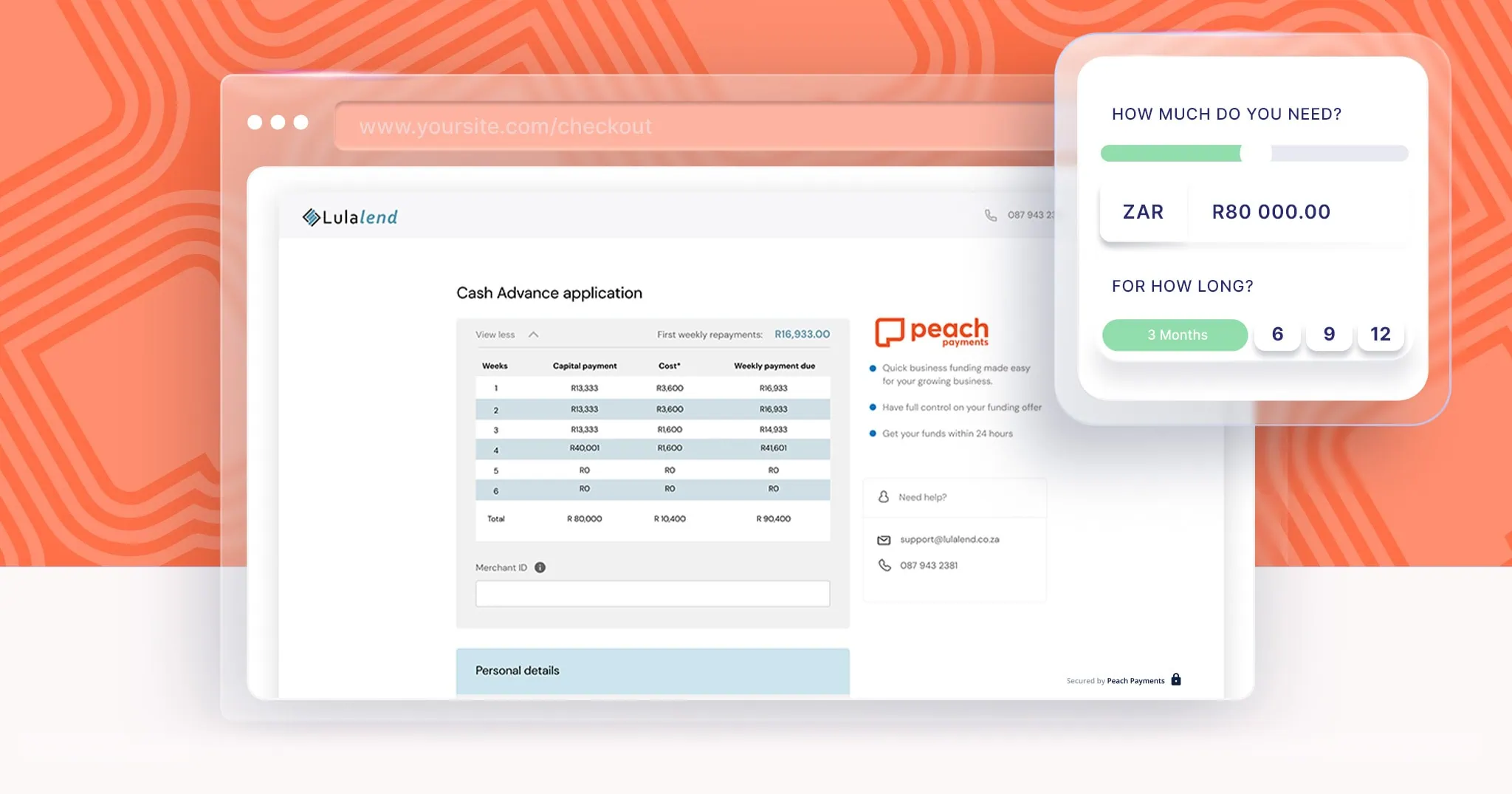

Investing in tomorrow: The benefits of business cash advance, and how to tell whether a cash advance is right for your business

Read More.png)

.png)

.png)

.png)

.png)