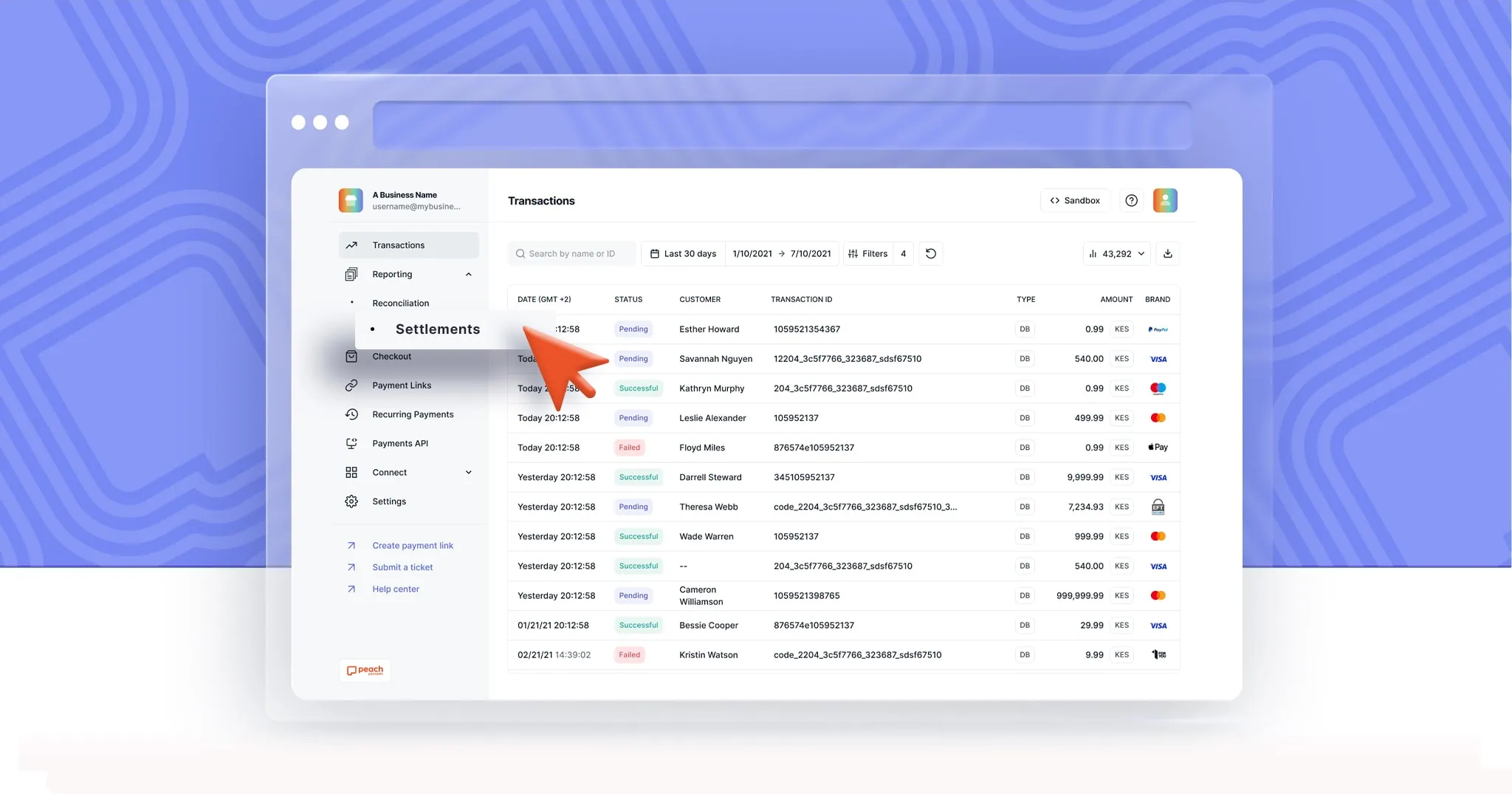

Peach Payments launches free and automated Daily Settlements for all merchants

Peach Payments is excited to offer daily settlements to all merchants making use of its online payment gateway.

Read More

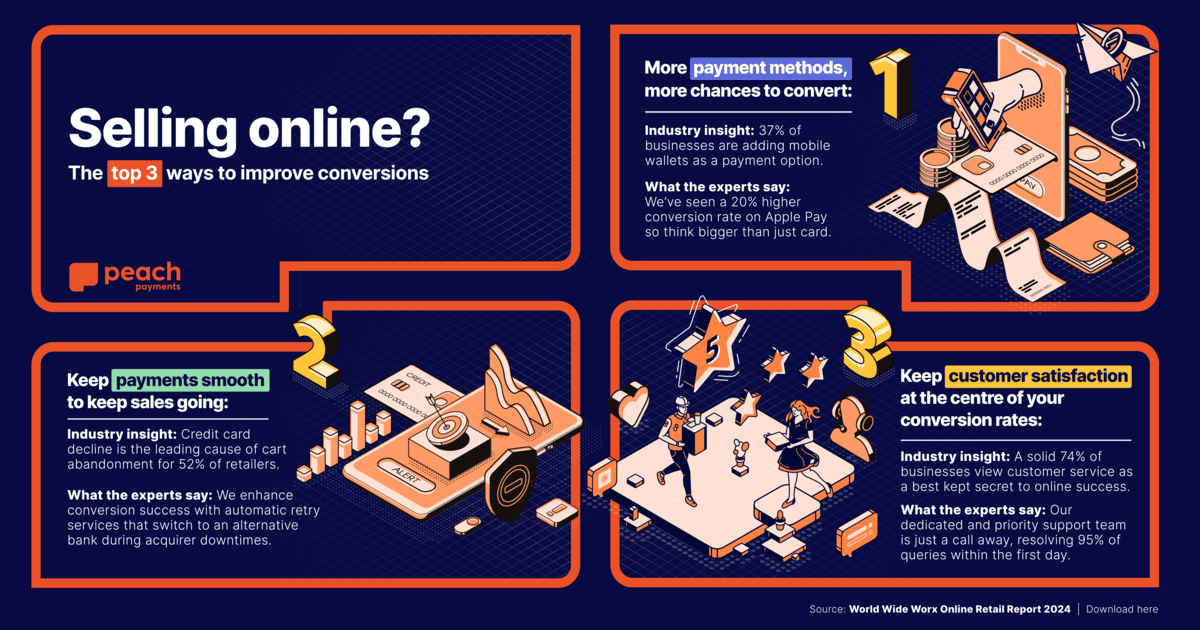

Running a successful Shopfiy store means converting every page visitor into a customer. Peach Payments wide range of payment methods can make that happen.

We all want our online businesses to reach as many people as possible, but have you considered all the ways your Shopify store could be excluding shoppers?

No, I’m not talking about your product range: a fish is never going to want to buy a raincoat. But what about those fish that found their lure on your site? It may be safe to assume you’ve got that sale in the bag.

But once that basket is packed and ready to go, your customers still have hurdles to overcome: how do they pay? The easy answer: the way they want to, and it’s up to you to ensure they can. It’s easy to imagine that everyone has a debit or credit card ready to make purchases, but the wider the net, the more diverse your catch becomes. There’s a world of payment methods out there, so let’s look at all the ways you can catch that sale.

Half of online shoppers look for multiple payment methods

Not everyone is comfortable with sharing their card details online. In South Africa, debit cards make up 33% of all online transactions and credit cards a further 17% — meaning that 50% of online shoppers look for other payment methods.

Looking closer at the stats, Instant EFT makes up a further 31%, and the final 19% is made up of alternate payment methods. It’s that 19% that needs to be looked at closely. 19% is not a number that can simply be ignored — if your turnover dropped by 19%, it would definitely be a cause for concern. So turning that around, without offering a wide range of payment methods, your Shopify store could be losing up to 19% of all possible sales.

It’s a tricky 19% to capture, especially considering the wide array of payment methods that exist. ApplePay is popular among those who are more familiar with online shopping and simply enjoy the convenience of the payment method. Even though these shoppers most likely have credit and debit cards to pay with, your Shopify store will stick out as modern and extra accessible for offering it.

Alternate payment methods

Then there’s the credit and installment offerings such as Mobicred, Payflex, and ZeroPay. These payment methods experienced a sudden spike in popularity ever since COVID lockdown encouraged many South Africans to start making purchases online. Where previously shoppers would have rather gone to a brick and mortar store to make big purchases, they’re now more adjusted to buying online.

Credit

The world of credit doesn’t end at credit cards. In fact, credit providers like Mobicred can provide customers with credit during checkout. They act like any other credit provider, and let your customers get instant approval for their purchases — with no risk to you.

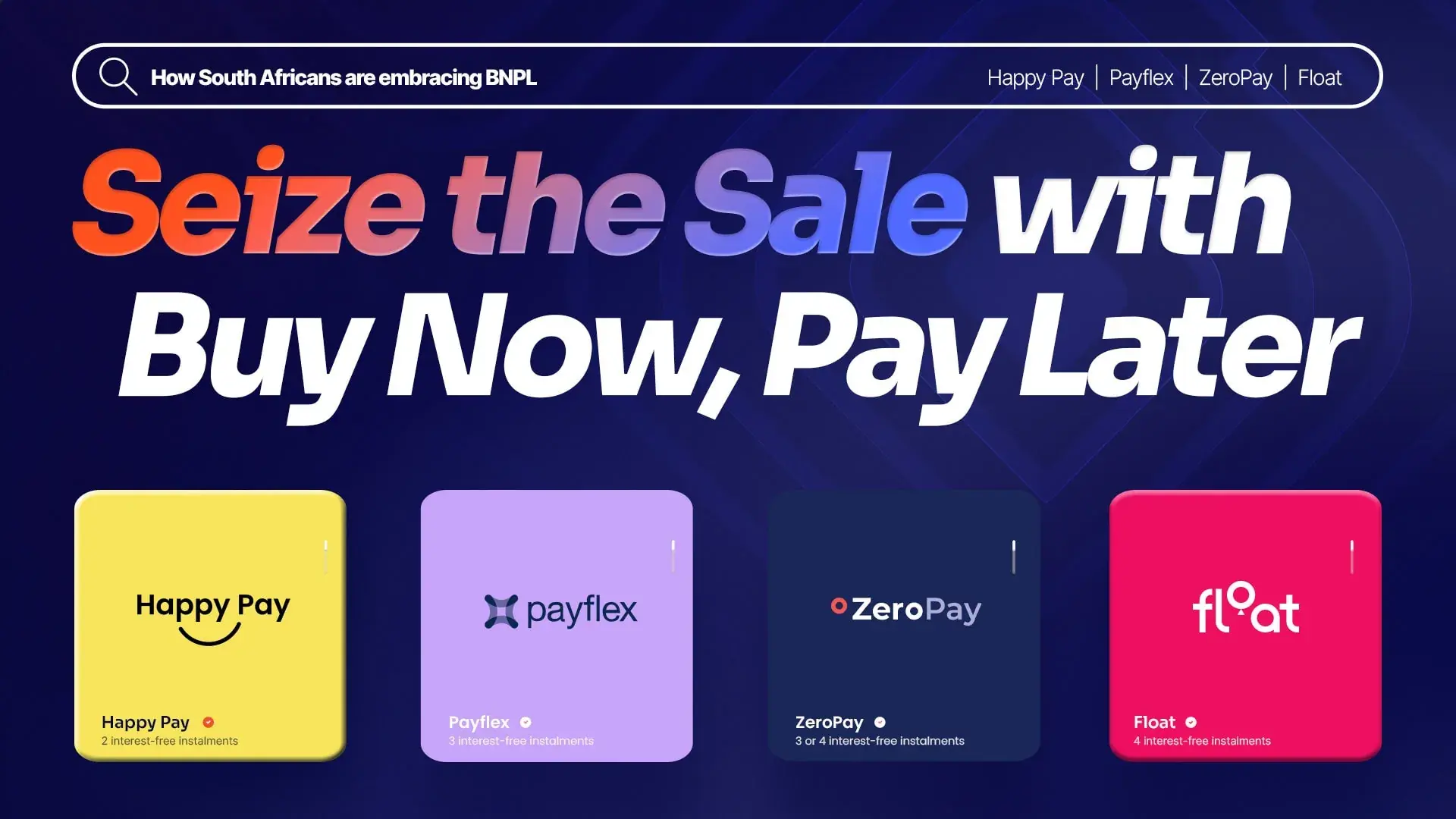

By now, pay later

Installment offerings let customers buy bigger. Customers can have purchases broken down into three installments with ZeroPay or four installments with PayFlex, interest free. Whether it’s one large item or a basket packed to the brim with smaller ones, shoppers can make purchases they would otherwise have saved up for, or purchased from month to month. We all know the benefits of retail therapy, and when the initial payment is only a quarter of the total, one can’t help but spend a little more.

Prepaid vouchers

But there’s still a payment method that needs to be considered, and as South Africa transitions into a fully digital age, it’s going to be the most important payment method to offer. 1Voucher has burst onto the scene with the biggest bang a payment method can make — and your Shopify store is going to miss an amazing opportunity to scale if you don’t offer it.

1Voucher allows customers to visit one of thousands of purchase points and buy a voucher they can redeem online. This suddenly instills a massive market with the confidence to buy online without the fear of submitting their bank card details.

Grow with payment methods

You can expect a rapid growth in online shopping in South Africa, and your Shopify store needs an online payment gateway that offers it. Don’t miss out on this massive opportunity to take your online business to the next level — connect with online payment gateways like Peach Payments and make sure you ride this new wave to success.

Watch this video on why giving your customers multiple payment options are important for your business.

Find out more about what Peach Payments can do for your Shopify store or click here to get started.

No spam. Just the latest news, ecommerce tips and tricks to help you scale your business.

Peach Payments is excited to offer daily settlements to all merchants making use of its online payment gateway.

Read More

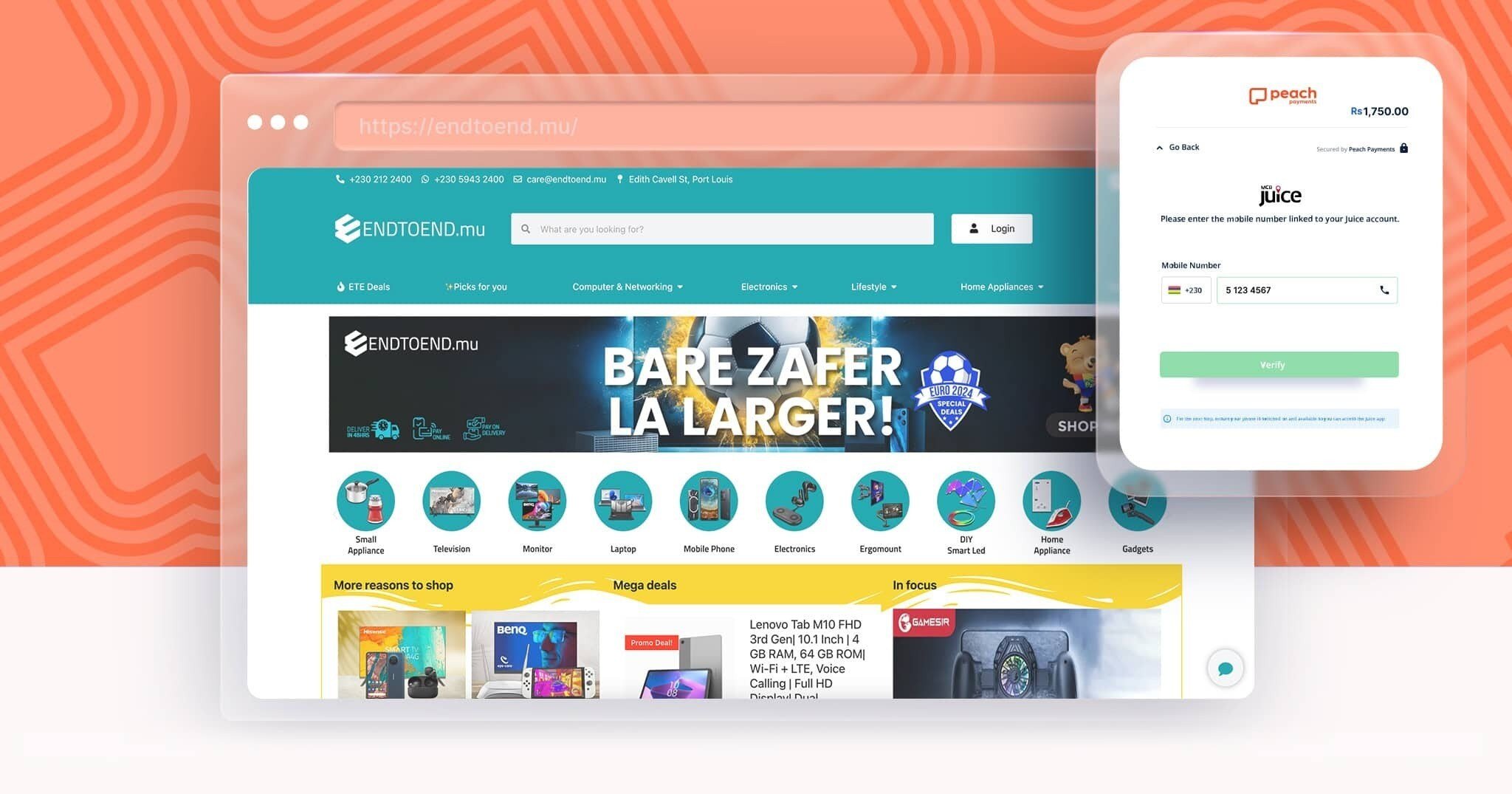

Peach Payments' alternative payment method, MCB Juice, has been instrumental in helping Endtoend.mu target a larger audience, making the platform more inclusive and accessible to shoppers from all corners of Mauritius.

Read More

Peach Payments is paving the way for a transformative 2025. From Pay by Bank to Embedded Checkout, explore how we revolutionised payments in 2024

Read More

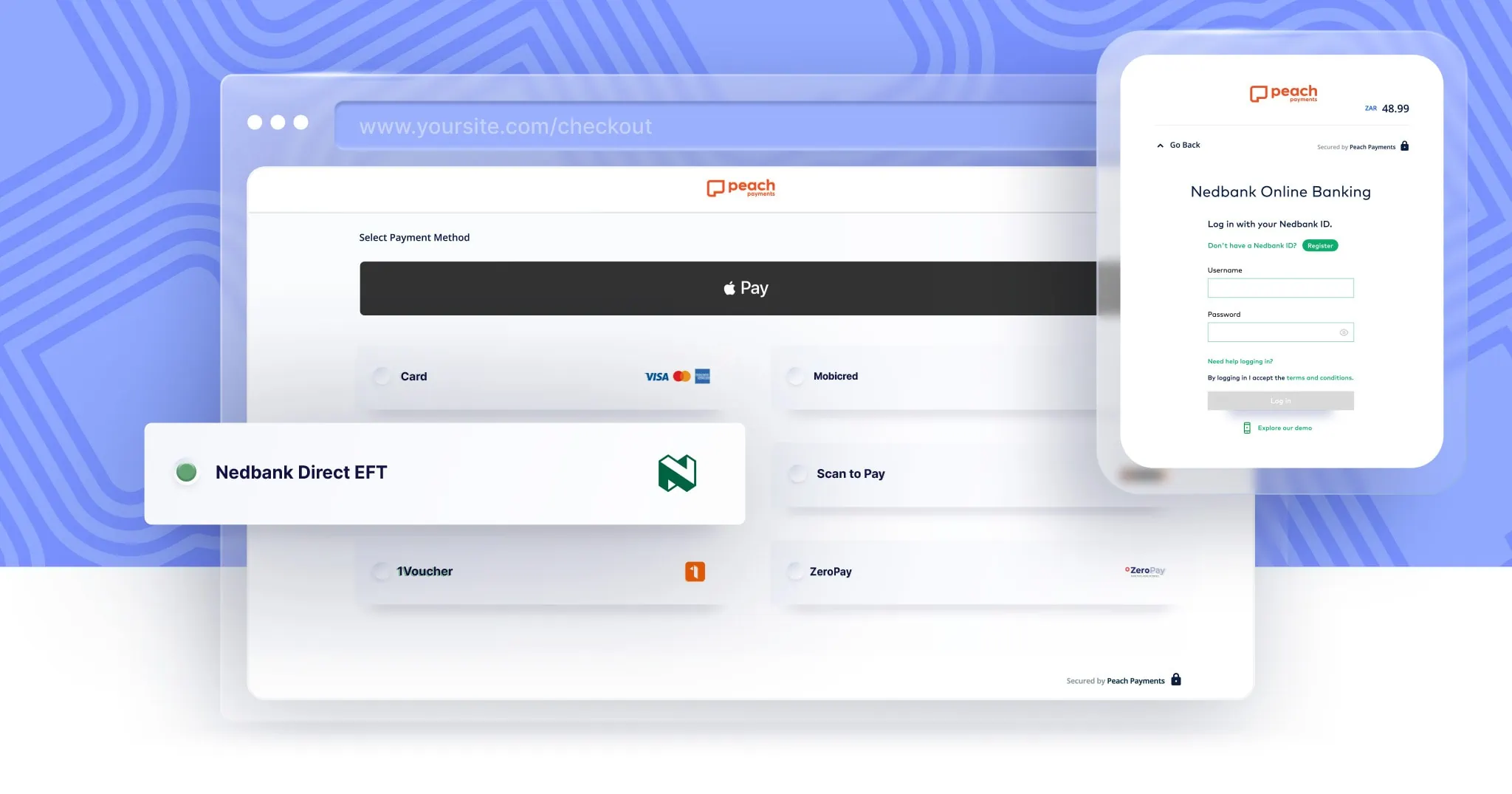

Nedbank Direct EFT is now available as a payment option on ecommerce websites that use Peach Payments, a leading South African payment gateway.

Read More

Discover how South Africans are embracing BNPL, and merchants are reaping the rewards.

Read More

The 2024 World Wide Worx report, sponsored by Peach Payments, Mastercard and AskAfrika, reveals that South Africa’s online retail surged to R71 billion in 2023, with projections to exceed R100 billion by 2026. Discover more key findings below to help your business succeed online.

Read More