Navigating International Transactions

Understanding Dynamic Currency Conversion (DCC) and Multi-Currency Pricing (MCP)

Read More

Everything you need to know about selling internationally from South Africa - currency converters, multi-currency accounts and everything in between.

With the internet connecting the world like never before, many South African ecommerce businesses have begun to sell their products in international markets. But how exactly does payment work, and what are the options for local merchants?

Update: In September 2023, we held a webinar about multi-currency. You can view it here.

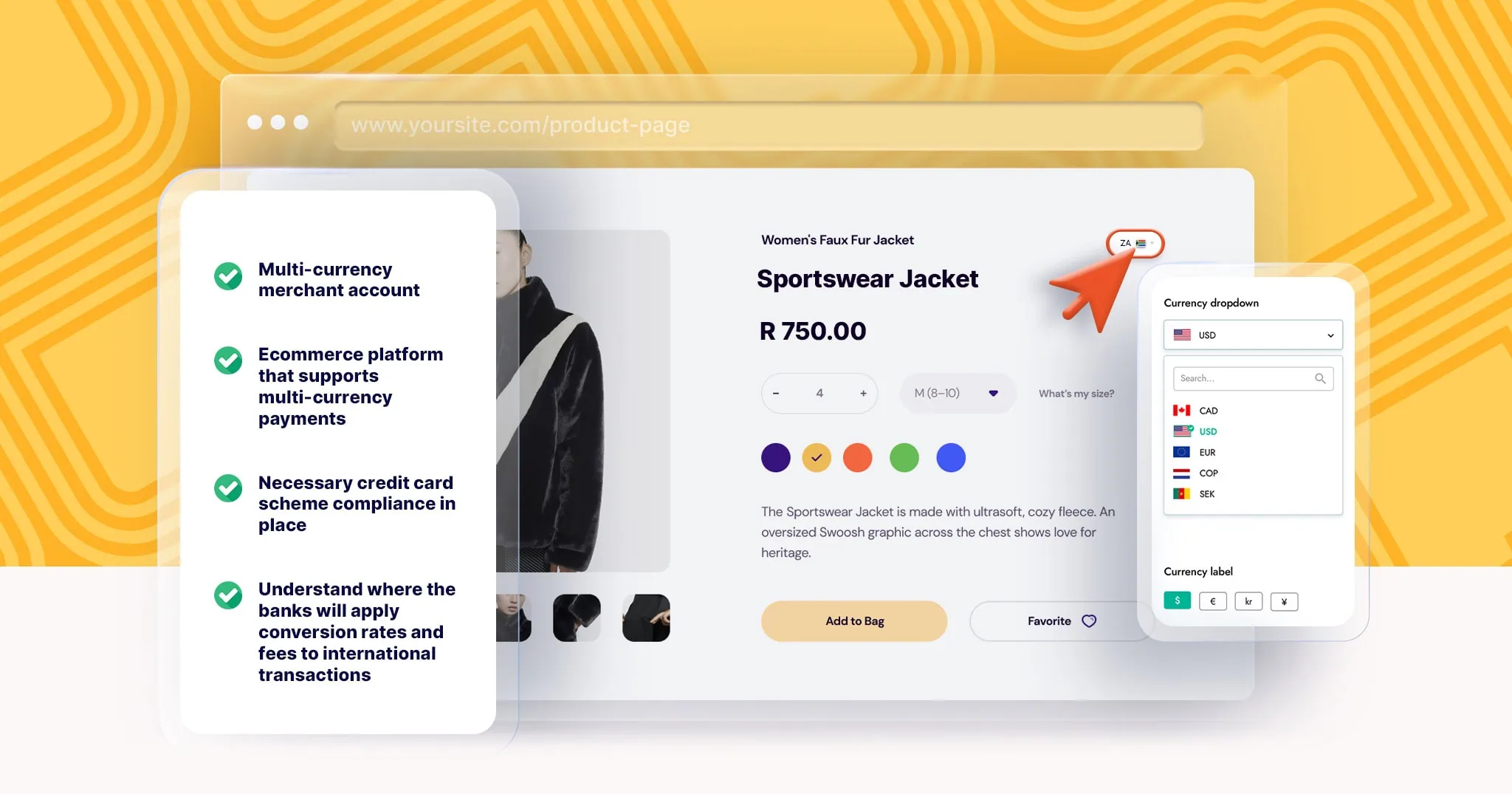

There are two main options for receiving international payments:

Importantly, in both of the above cases you can display prices in foreign currency. In the first instance, by using a currency converter plug-in on a website configured in ZAR, and in the second, by configuring your website in the base currency in which your customers transact. Bear in mind that customers may not be charged exactly what the currency converter displays, because the issuing bank still needs to apply whatever the current exchange rate is before charging the card.

With that out of the way, let’s look at each of the above cases in a bit more depth:

Accepting foreign cards and selling in ZAR

Off the bat, you will need to make sure your payment gateway is set up to accept foreign cards. Payment gateways will often block foreign cards as a matter of course, and in some cases, do not allow foreign cards to transact at all, due to worries about fraud. At Peach Payments, all our merchants can accept foreign cards (although there are sometimes exceptions based on the industry in which the merchant operates).

A couple of things to consider when going this route:

Multi-currency selling

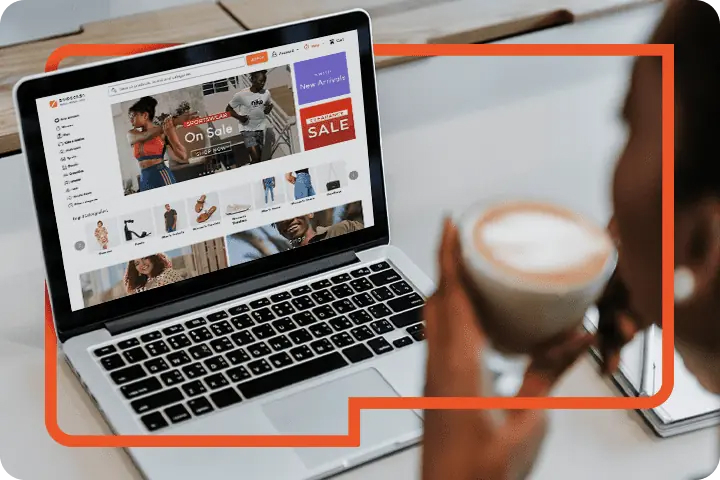

In the case of multi-currency selling, you would price the product in the currency in which your customer will be paying, and your payment gateway would process the payment in that currency (i.e. there is no conversion rate applied to the amount during the transaction - although there will be when the acquiring bank or your payment gateway settles the transaction to your bank account).

Key consideration with the multi-currency approach:

A final international ecommerce consideration: fulfilment

For merchants selling services or digital products, fulfilment is less of a problem. But in the case of physical products, there are several areas about which you want to think:

At Peach Payments we’ve been helping merchants sell internationally for over a decade. If you have any questions, feel free to get in touch with us.

UPDATE: We had a webinar in September, 2023 explaining how to start with Shopify and WooCommerce for multi-currency checkout. You can view it here.

No spam. Just the latest news, ecommerce tips and tricks to help you scale your business.

Understanding Dynamic Currency Conversion (DCC) and Multi-Currency Pricing (MCP)

Read More

Start using multi-currency on your website. Everything you need to know to start on Shopify, WooCommerce, and your custom website.

Read More

Everything you need to know about using Peach Payments' payment gateway in high-risk industries, like dropshipping, betting and marketplaces.

Read More

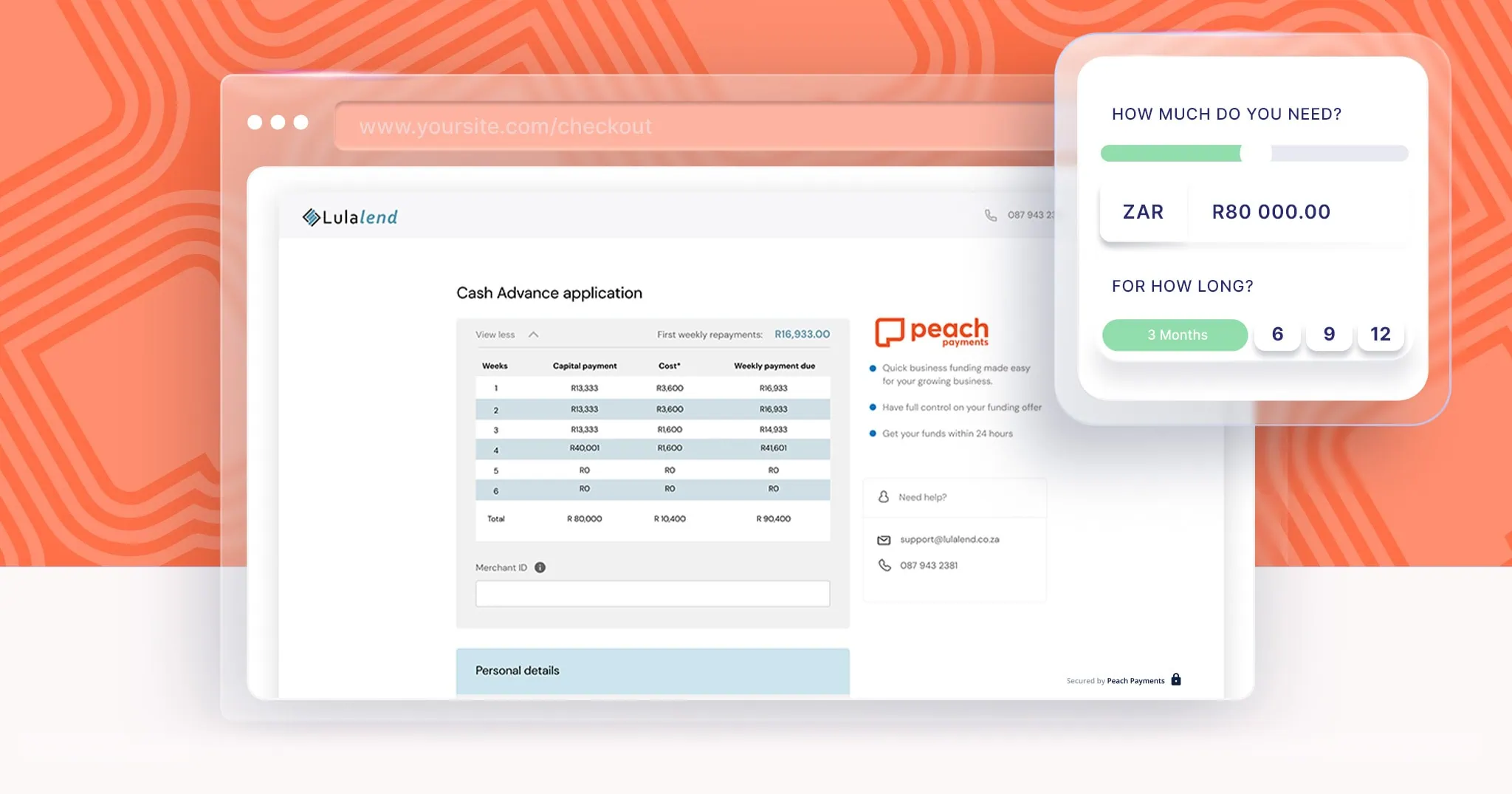

Investing in tomorrow: The benefits of business cash advance, and how to tell whether a cash advance is right for your business

Read More

With a focus on quality, community, and customer satisfaction, Bloomable stands out as a pioneer in the online marketplace, transforming the way local florists connect with their customers and compete in the digital landscape.

Read More

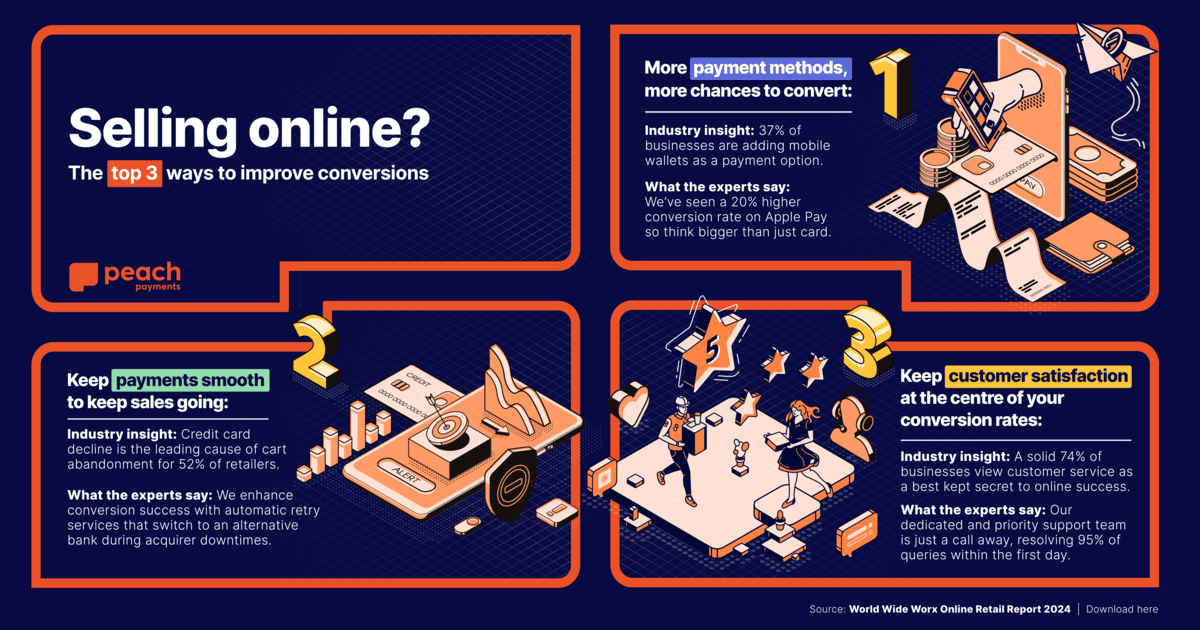

The 2024 World Wide Worx report, sponsored by Peach Payments, Mastercard and AskAfrika, reveals that South Africa’s online retail surged to R71 billion in 2023, with projections to exceed R100 billion by 2026. Discover more key findings below to help your business succeed online.

Read More.png)

.png)

.png)

.png)

.png)