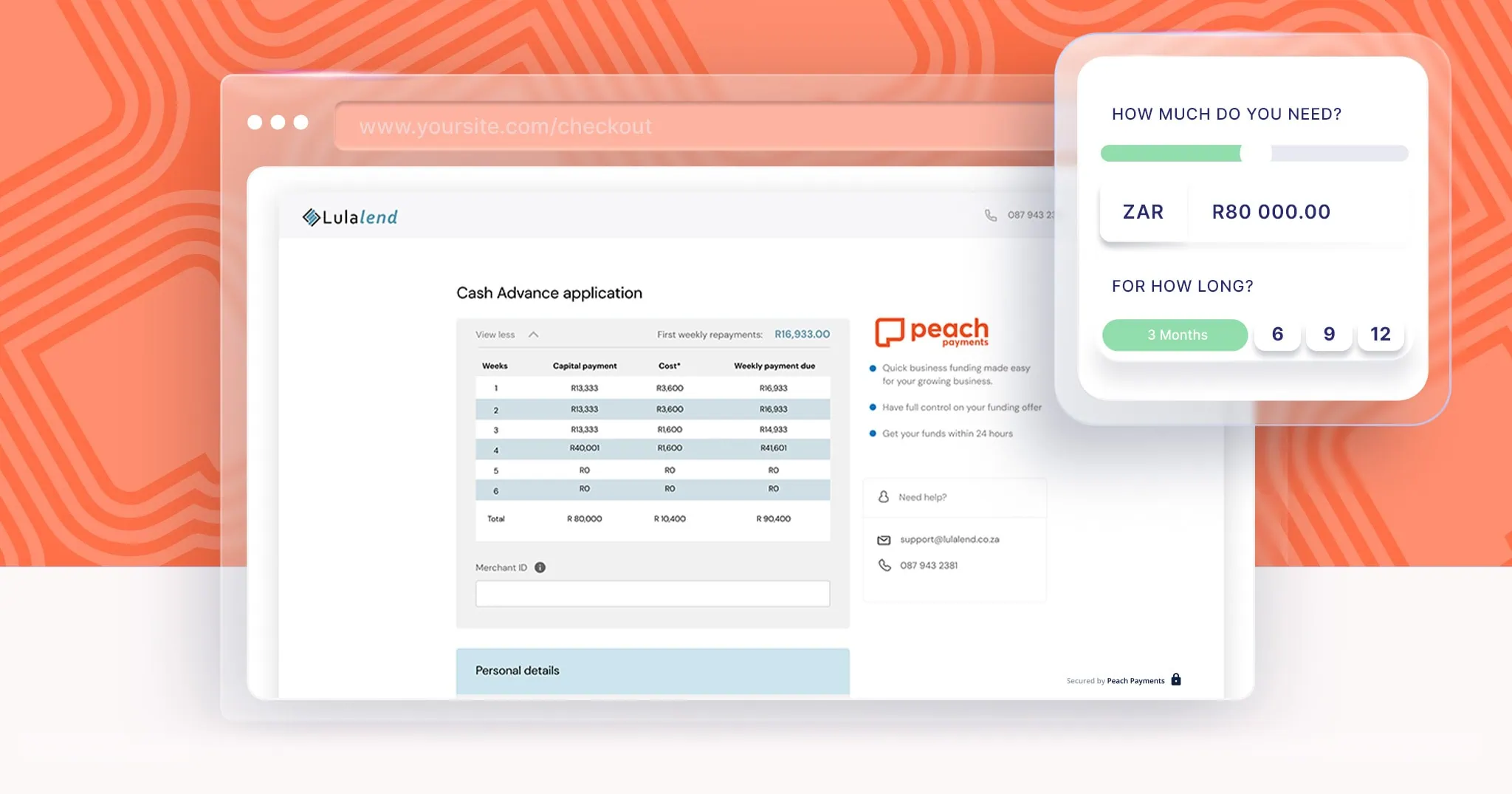

Strategic Borrowing: Maximizing the Impact of Business Cash Advance

Investing in tomorrow: The benefits of business cash advance, and how to tell whether a cash advance is right for your business

Read More

Understanding Dynamic Currency Conversion (DCC) and Multi-Currency Pricing (MCP)

Ever wonder how the price of that souvenir changes when you pay with your card abroad? Or why some online stores show prices in your currency while others don't? It's all down to Dynamic Currency Conversion (DCC) and Multi-Currency Pricing (MCP), and understanding the difference can save you money and headaches. These are crucial considerations in the increasingly global economy, with cross-border transactions projected to reach a staggering $290 trillion by 2030.

Decoding Dynamic Currency Conversion (DCC)

Imagine you're on vacation and find the perfect gift. You go to pay, and the Point of Sale machine asks if you want to pay in your home currency. That's DCC in action. It offers the convenience of seeing the price in your familiar currency right then and there. However, this convenience comes at a cost.

Multi-Currency Pricing (MCP): A Different Approach

MCP offers a more transparent pricing model. Imagine browsing an online store where prices are displayed in your local currency throughout your entire shopping journey. That's MCP.

DCC vs. MCP: A Comparative Look

|

Feature |

DCC |

MCP |

|

Pricing |

Price shown in home currency at checkout |

Price shown in local currency throughout |

|

Exchange Rate |

Markup applied, potentially less favorable |

Typically uses prevailing market rates |

|

Fees |

Includes a markup/conversion fee |

Generally lower transaction fees |

|

Transparency |

Less transparent, markup not always clear |

More transparent, prices clearly displayed |

|

Customer Impact |

Potential for surprise fees, dissatisfaction |

Increased price transparency, customer trust |

|

Business Impact |

Revenue from markups, less exchange rate risk |

More exchange rate risk, requires price management |

Addressing the Challenges

Both DCC and MCP present challenges for business. Here's how you can address them:

Financial Implications for Businesses

Which Approach is Right?

The optimal choice between DCC and MCP depends on the specific business context:

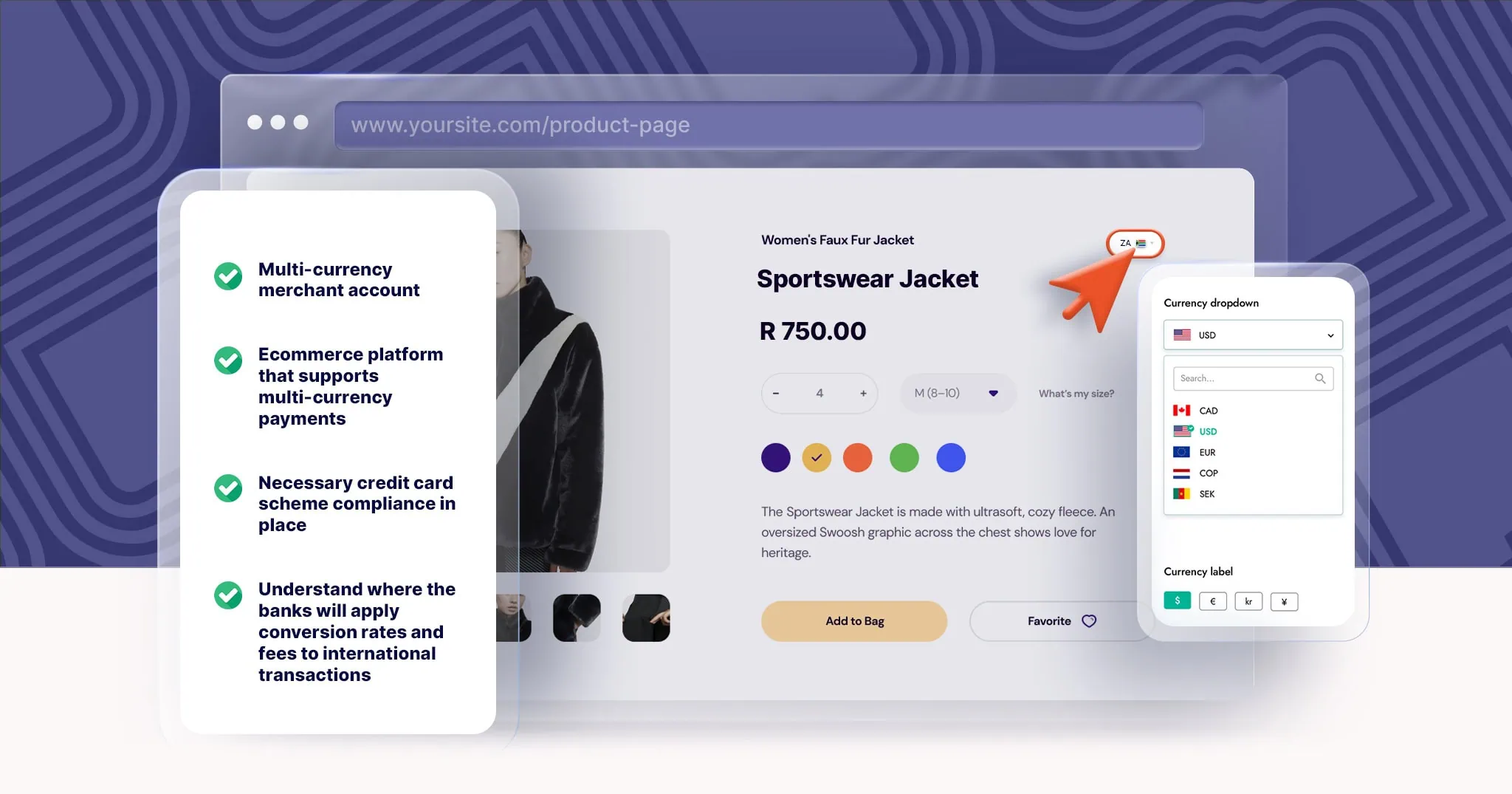

How Peach Payments helps

Peach Payments offers MCP for our South African and Mauritian merchants. In South Africa, we can help you register for an ABSA multi-currency account and accept payments in multiple currencies with ease and get free daily settlements in Rands. If you have a Mauritian business, we can register you for an MCP account with the Mauritius Commercial Bank and even settle you in a foreign currency like U.S. Dollars. Dynamic Currency Conversion (DCC) is on our roadmap—stay tuned for updates!

Conclusion

Choosing between DCC and MCP is a crucial decision for businesses operating in the global marketplace. Careful consideration of the business model, target audience, and operational capabilities is essential. Both approaches can enhance the customer experience when implemented thoughtfully. By understanding the nuances of each method, businesses can make informed decisions that benefit both themselves and their customers.

No spam. Just the latest news, ecommerce tips and tricks to help you scale your business.

Investing in tomorrow: The benefits of business cash advance, and how to tell whether a cash advance is right for your business

Read More

Start using multi-currency on your website. Everything you need to know to start on Shopify, WooCommerce, and your custom website.

Read More

With a focus on quality, community, and customer satisfaction, Bloomable stands out as a pioneer in the online marketplace, transforming the way local florists connect with their customers and compete in the digital landscape.

Read More

What measures should business owners take to manage risk and fraud with ecommerce.

Read More

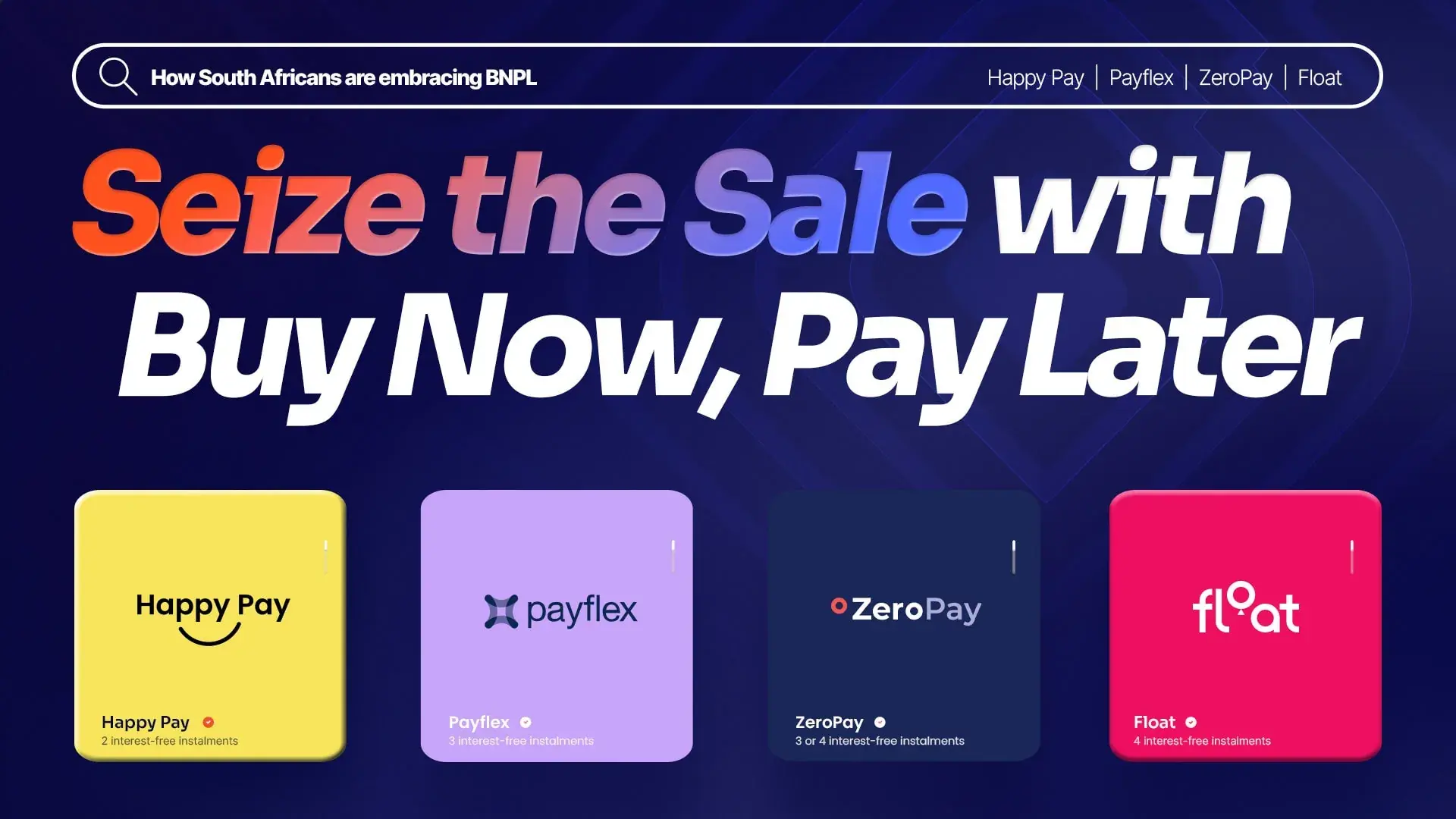

Discover how South Africans are embracing BNPL, and merchants are reaping the rewards.

Read More.png)

.png)

.png)

.png)

.png)