Peach Payments named Top 100 Fintech Startups by CB Insights

Learn how Peach Payments made the 2024 Top 100 Fintech Startups by CB Insights, recognised for innovation and excellence in financial technology

Read More

Apis Growth Fund II leads round

Baobab Payments GmbH, trading as Peach Payments, has concluded a €29M / US$30M funding round. The round, announced in April, was led by Apis Growth Fund II (the “Fund”), a private equity fund managed by Apis Partners LLP (“Apis Partners”), a UK-based asset manager.

Peach Payments is an enterprise-grade digital payment service provider that enables online payments in Africa for businesses of all sizes. In April 2023, Apis Partners announced the Fund’s intention to invest in Peach Payments as part of a funding round consisting of a mix of primary and secondary investments.

Says Rahul Jain, CEO and co-founder of Peach Payments, “This funding has been raised to accelerate growth and will be used to build out new products and expand into new countries in Africa. We also intend to double down on the markets in which we already have a presence - South Africa, Kenya, Mauritius - to grow market share, expand our headcount and launch new products. All these actions have the core focus of serving our merchants and helping them to scale their businesses.”

Businesses that use Peach Payments in one country don't need to find a new payment partner when they expand to a new African country - they can just grow into the new geography, Jain explains. The payment platform hopes to expand this functionality across the continent’s 54 countries, some with as many as 12 payment methods, including credit cards, debit cards, instant EFTs, multiple buy-now-pay-later options and electronic vouchers.

“For businesses targeting consumers across Africa, this fragmentation in payment methods and stores of value makes it incredibly complicated to accept payments in their digital channel,” Jain explains. “Peach Payments already abstracts that complexity for merchants in the countries where we are operational. We want to expand this to more African countries, and are evaluating a number at this time.”

Udayan Goyal, Co-Founder and Managing Partner, Apis Partners, commented: “We look forward to leveraging Apis’ capital, expertise and global network to support new investment in Peach Payments’ infrastructure, products and people to consolidate the company’s recent gains and support the next phase of growth,”

Consumers will benefit, Jain says, by having an easy online payment experience with enterprise-grade security and access to cross-border payments. This will allow them to buy goods and services internationally while using local payment methods. For merchants, the expansion of the payment platform will bring additional opportunities to expand their businesses internationally.

“The Apis team brings an incredible wealth of experience in fintech across the globe and we look forward to exploring exponential opportunities together with them. Their ability to listen and advise on strategic moves is a valuable asset for any startup along its journey. We specifically wanted a shareholder that was not a helicopter investor but would be actively involved in helping us grow the business,” Jain says of the value-add Apis Partners brings to the deal.

As an ESGI-native investor, Apis Partners’ sector expertise will help Peach Payments to maximise financial inclusion by enabling more merchants to participate and grow in today’s increasingly digital global economy.

“We continue to see significant opportunities in African payments as strong secular trends that are not related to annual business cycles – such as the conversion from cash to digital and in-store to online payments – persist across key markets. We have been impressed by the vision and execution Peach Payments’ management team has brought to bear to capitalise on these trends. We look forward to working with Peach Payments to expand its reach into new markets with innovative merchant solutions,” says Matteo Stefanel, Co-Founder and Managing Partner, Apis Partners.

Jain says the new funding means Peach Payments can now move faster, “Previously, we were constantly choosing one priority at a time. The capital we now have makes it possible to do three things in parallel, which improves our speed of execution.”

The legalities of the funding round were handled for Apis Partners by Webber Wentzel and by V14.de for Peach Payments. The deal received approval from South Africa’s Competition Commission in May, the customary requirements for deals of this nature were met in August and funds were transferred earlier this month.

No spam. Just the latest news, ecommerce tips and tricks to help you scale your business.

Learn how Peach Payments made the 2024 Top 100 Fintech Startups by CB Insights, recognised for innovation and excellence in financial technology

Read More

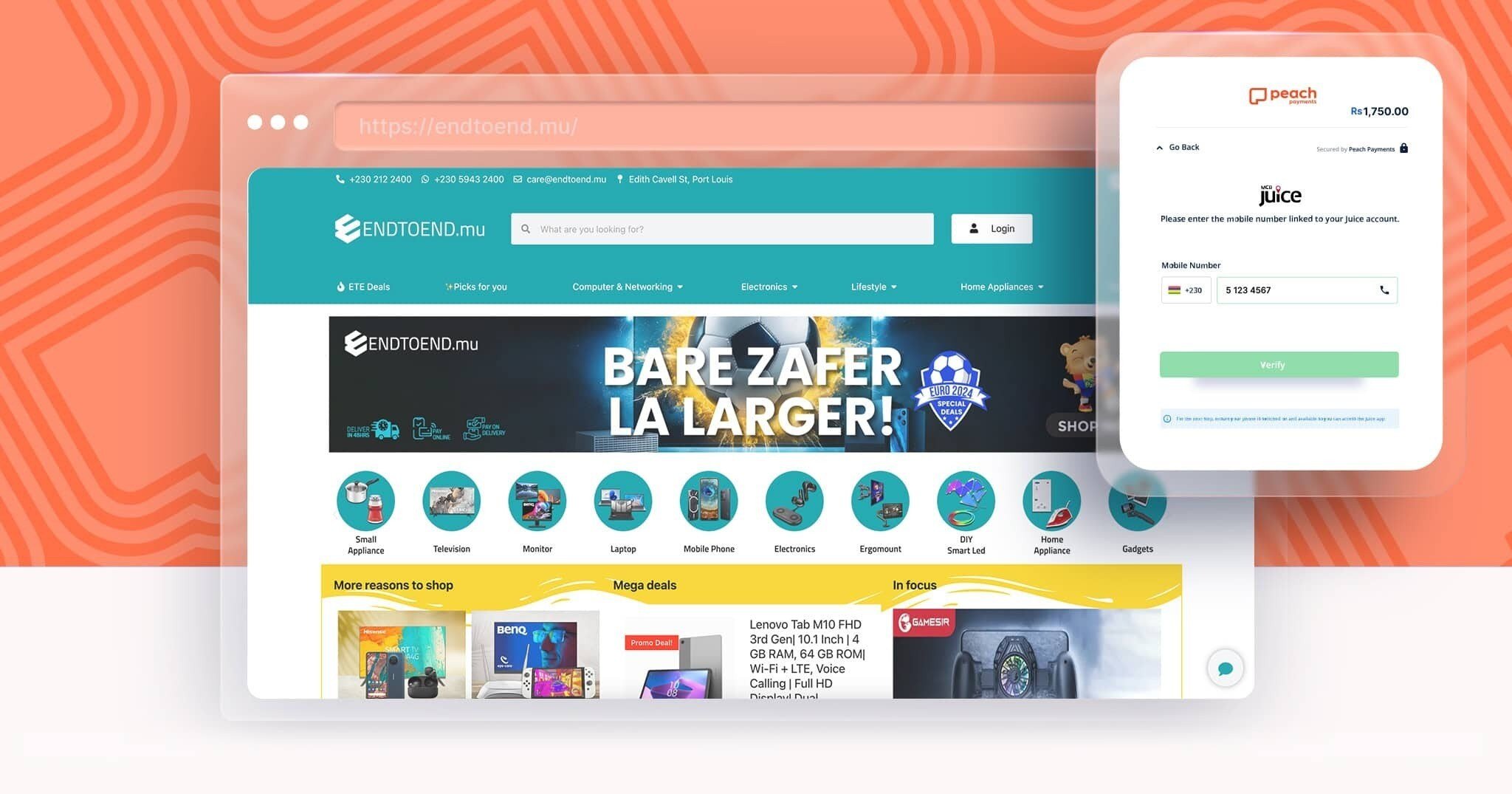

Peach Payments' alternative payment method, MCB Juice, has been instrumental in helping Endtoend.mu target a larger audience, making the platform more inclusive and accessible to shoppers from all corners of Mauritius.

Read More

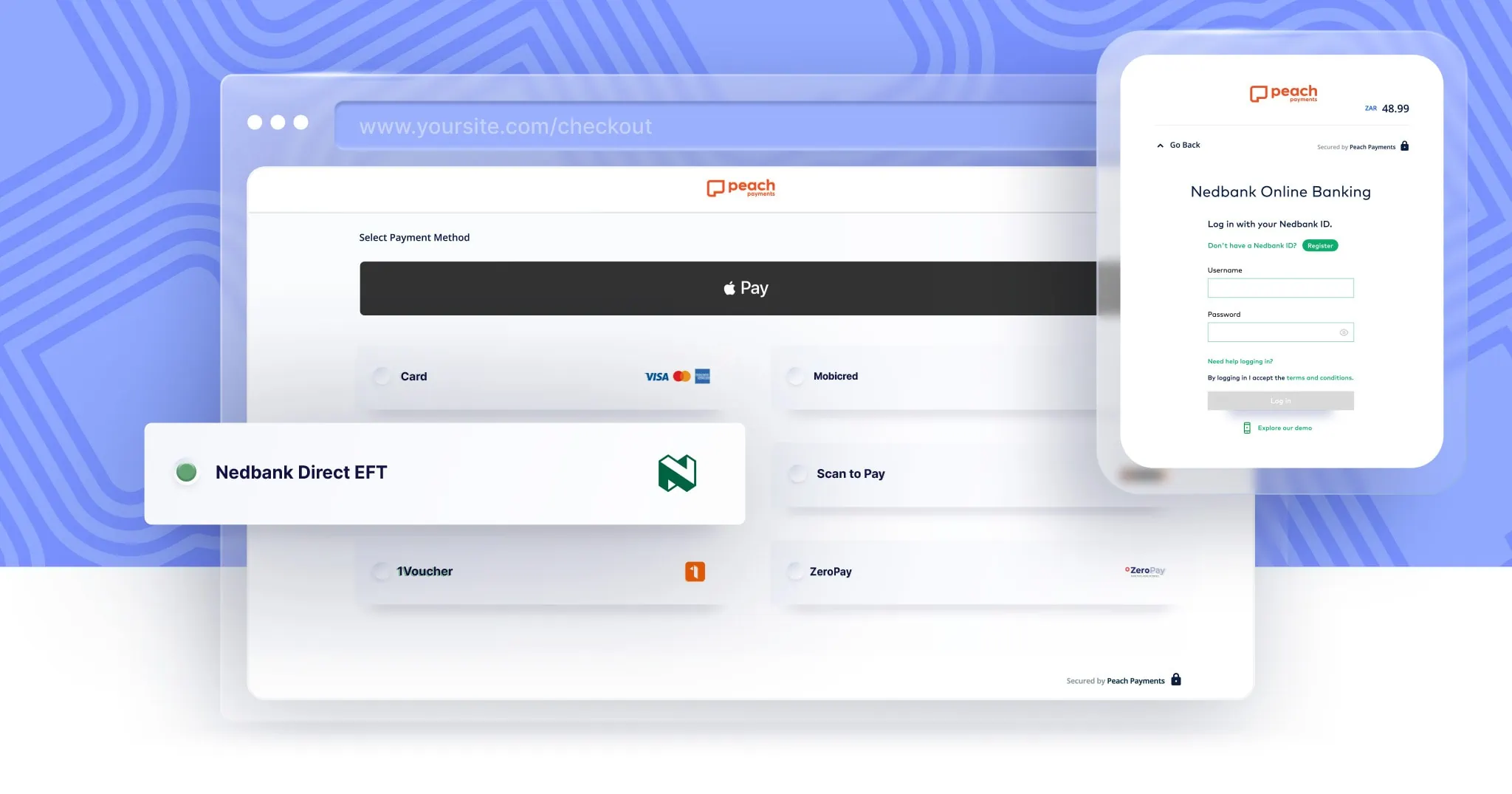

Nedbank Direct EFT is now available as a payment option on ecommerce websites that use Peach Payments, a leading South African payment gateway.

Read More

Discover the impactful journey of Peach Payments innovating payment solutions over the past 12 years, and future plans to empower businesses across Africa.

Read More

Peach Payments is paving the way for a transformative 2025. From Pay by Bank to Embedded Checkout, explore how we revolutionised payments in 2024

Read More

Partnership opens up WhatsApp sales channel for merchants preparing for Black Friday

Read More.png)

.png)

.png)

.png)

.png)