Watch how South Africans are buying on Black Friday

Peach Payments today launches its Black Friday Dashboard live on its website

Read More

SMEs like SweepSouth use Peach Payments as their online payment gateway for their industry leading customer support, high conversion rate, subscription payment options and secure transactions.

SweepSouth has been pushing the envelope of online transactions since 2014 when South Africans were still untrusting of online payments. Peach Payments have worked alongside them in helping the technology grow and gaining the trust of their customers. We sat down with SweepSouth CEO & Co-founder, Aisha Pandor for #MerchantMornings to look back at our journey together and all we’ve accomplished.

“We wanted to solve that problem: to ensure that providers in the industry work under dignified conditions and make a fair earning.“ Aisha Pandor, SweepSouth Co-founder

Tell us about your company and the problem you are trying to solve in your respective market?

I’ve always wanted to help people. I studied to become a geneticist and though I’ll always have a love of science, the lab is just too far removed from helping people on a daily basis. My husband, SweepSouth Co-founder, Alen Ribić, who comes from a technical background, felt the same way. So about seven years ago, we resigned from our jobs to start a business that could make a real difference in people’s lives, even though we weren’t even sure how we’d do it.

The idea for SweepSouth came about when our nanny and house cleaner was going away on holiday and didn’t know exactly how long she’d be gone. We needed someone to step in temporarily that could work around a flexible schedule. Due to the shaky infrastructure of hiring nannies and cleaners in South Africa, it was incredibly frustrating, to say the least.

However, in this process, we started to see how poorly managed the domestic work industry really is. There’s a complete lack of transparency and cleaners are treated poorly because of how they’re perceived. We wanted to solve that problem: to ensure that providers in the industry work under dignified conditions and make a fair earning.

We thought it was as simple as saying, Uber exists, just give us that except for domestic work. Our devs let us know that it was not that simple and that if I wanted to get on board with a tech-based venture, I needed to learn how complex building a platform can be. So I went out and studied some Python and HTML and got an understanding of our initial limitations. We settled on building something relatively basic and manual for our first version of the SweepSouth platform.

It took a lot of face-to-face time with our customers to understand their needs, but over the years we managed to gain some traction. From those humble beginnings we now have a team of 55 people in South Africa, Kenya, and soon, Nigeria. We’ve extended our offering to cater to electricians, plumbers, and other outdoor services, and we’ve helped over 250 000 service providers connect with customers.

Not only have we helped our SweepStars (the providers on our platform) find employment, but enabled them to earn decent rates under dignified conditions. Meanwhile, customers can source their services in an ethical way.

Why did you choose Peach Payments and what impact have we had on helping your business grow?

We initially tried to support other entrepreneurs, but it became apparent that they didn’t even understand our problems, let alone how to solve them. When we moved over to Peach, it became clear that their customer centricity would be key to making our online transactions trustworthy and secure. They’ve evolved alongside us and it’s driven a lot of success.

When we began, online payments weren’t a common thing in South Africa. We were still researching whether ecommerce would ever find its place here. The banking systems weren’t exactly ready for these sorts of transactions. I spent days on the phone with banks, getting the runaround, being constantly transferred to the wrong person because everyone thought we were only looking to set up our internet banking for point of sales. I ended up crying on the phone because they just didn’t understand online payments.

So Peach has had a huge impact on how we do business. They approached our payment issues in a clear cut way: what problem are we trying to solve? Let’s solve it. Peach lobbied banks for a more convenient payment process other than 3D secure, which was the standard at the time. Transactions took far too long to process so if things didn’t change, it would destroy a lot of business models. We needed something that could bring one-click sales into reality.

Now, we’re a thousand times bigger than when we started our partnership with Peach and they’ve helped us solve every problem we’ve thrown their way. It’s not that our problems have become easier over the years, but Peach is always asking, ‘What do you need from us?’ and it’s that sort of provider relationship that ensures that our growth is always being catered for.

How has the national COVID lockdown impacted your business and what has it taught you?

2020 was incredibly tough. I had to really focus on handling my stress levels and balancing my life so that I didn’t spend every minute of my day focusing on the business. The choice was either not coping with stress or finding a coping mechanism.

We couldn’t operate for 2 months. We hadn’t anticipated COVID or its impact. Even when we were still operating, people immediately became wary of person to person exposure, and it only got worse as lockdown levels were going up and down. We had our first flat year ever and it took nine to ten months to get back to our pre-pandemic performance. Until then, we had thousands of women who weren’t able to work. We were really fortunate to get support from customers and investors, and as a result, we were able to put together a fund that supported our SweepStars from April to October 2020. But eventually, things got to a point where we had to retrench, which was incredibly difficult.

People have finally engaged again and we want it to stay that way. If nothing else, 2020 helped us refocusing our priorities; our SweepStars and our customers. We cut out the things that we weren’t sure about. We asked ourselves, ‘What do we want to achieve?’, focused on that, and lost the rest.

If you’re looking for an online payment gateway that offers a seamless checkout experience for your customers, enterprise-grade security for your store, and personalised support to you, click here to see what Peach Payments can do for you.

No spam. Just the latest news, ecommerce tips and tricks to help you scale your business.

Peach Payments today launches its Black Friday Dashboard live on its website

Read More

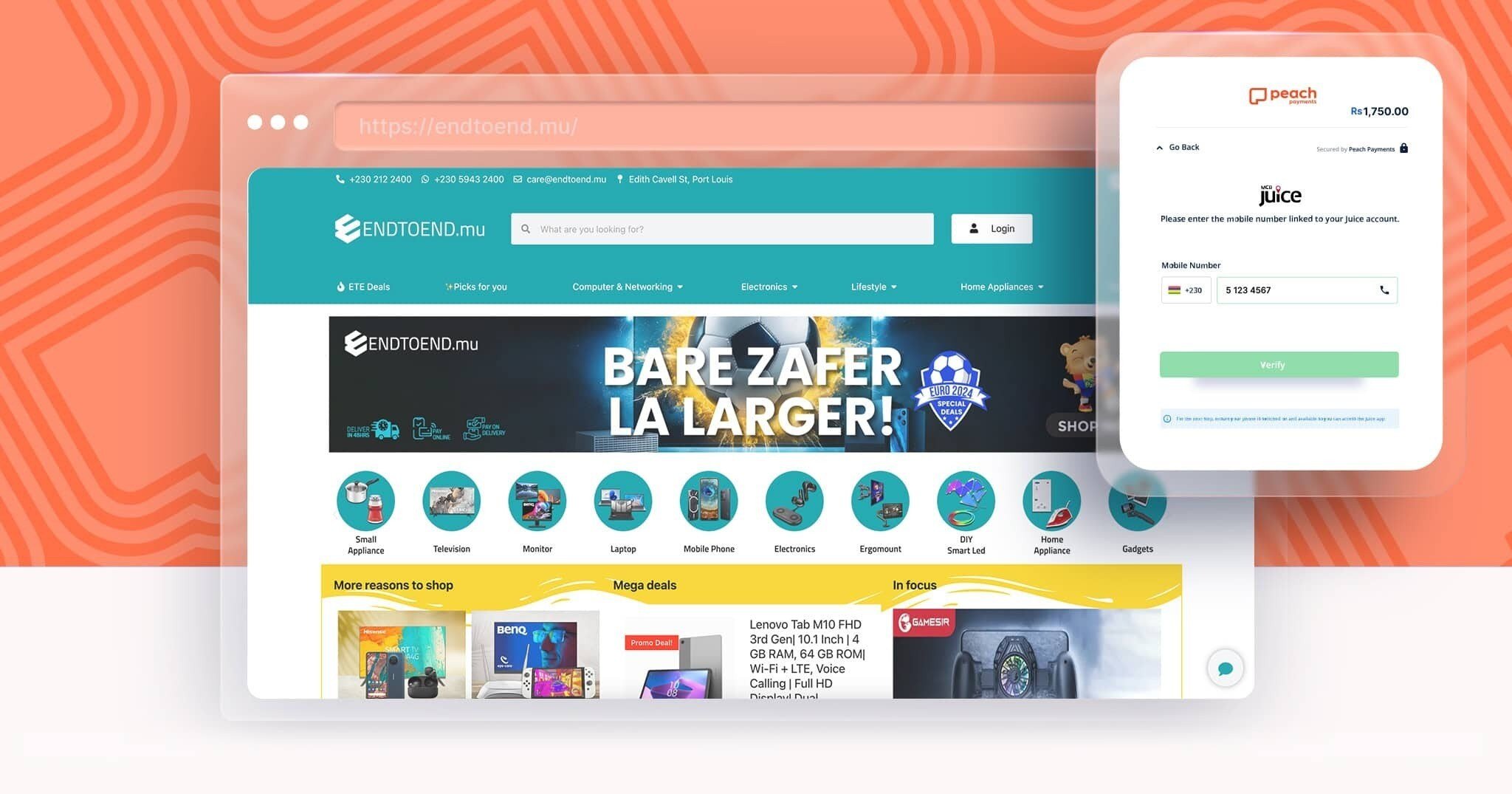

Peach Payments' alternative payment method, MCB Juice, has been instrumental in helping Endtoend.mu target a larger audience, making the platform more inclusive and accessible to shoppers from all corners of Mauritius.

Read More

South Africa-based digital payments platform Peach Payments shares weekend results

Read More

Peach Payments' latest innovations and future plans, emphasising customer-centric solutions and trailblazing advancements in the African payments industry.

Read More

Discover the impactful journey of Peach Payments innovating payment solutions over the past 12 years, and future plans to empower businesses across Africa.

Read More

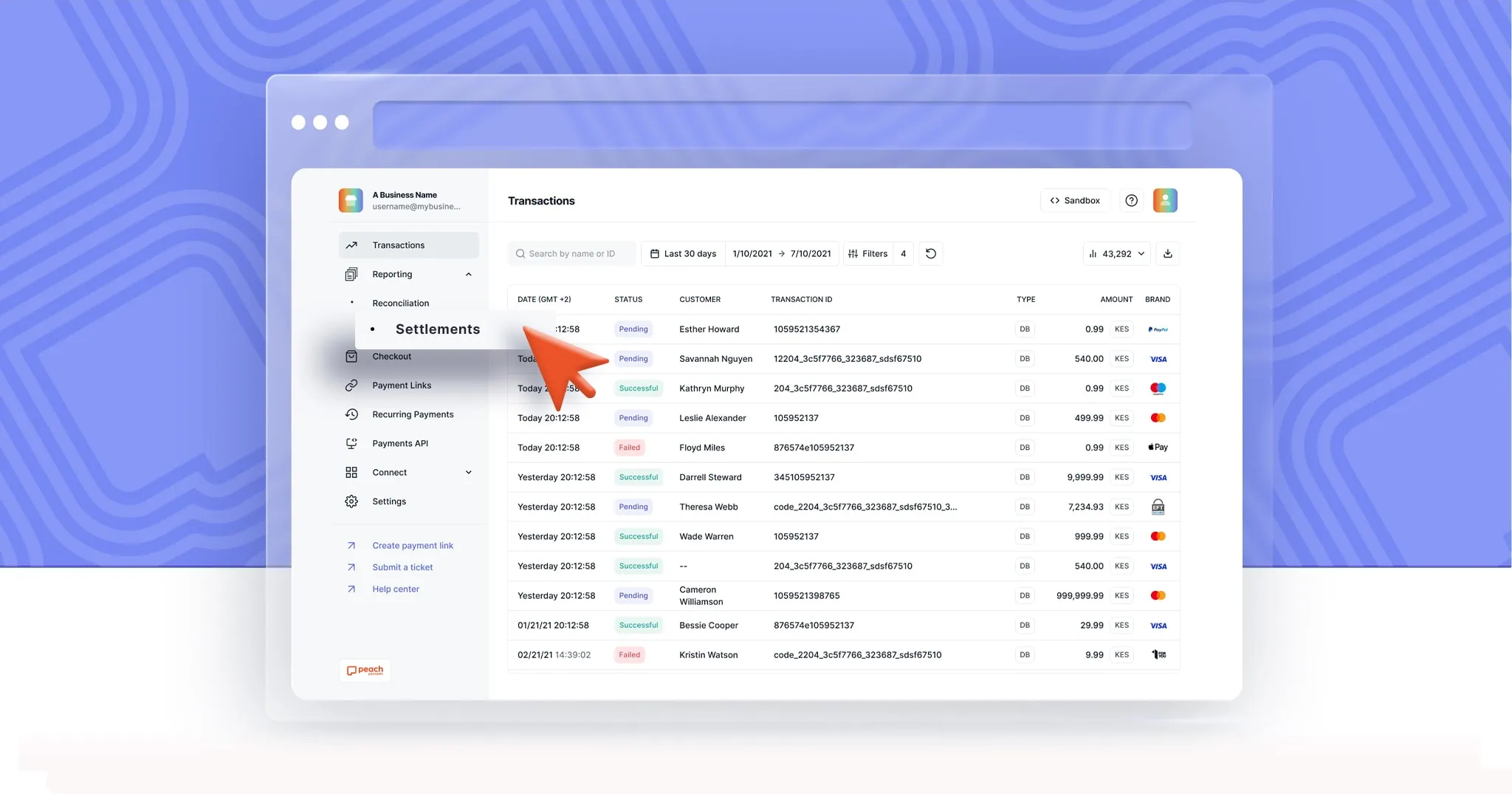

Peach Payments is excited to offer daily settlements to all merchants making use of its online payment gateway.

Read More.png)

.png)

.png)

.png)

.png)