Understanding Fraud

What measures should business owners take to manage risk and fraud with ecommerce.

Read More

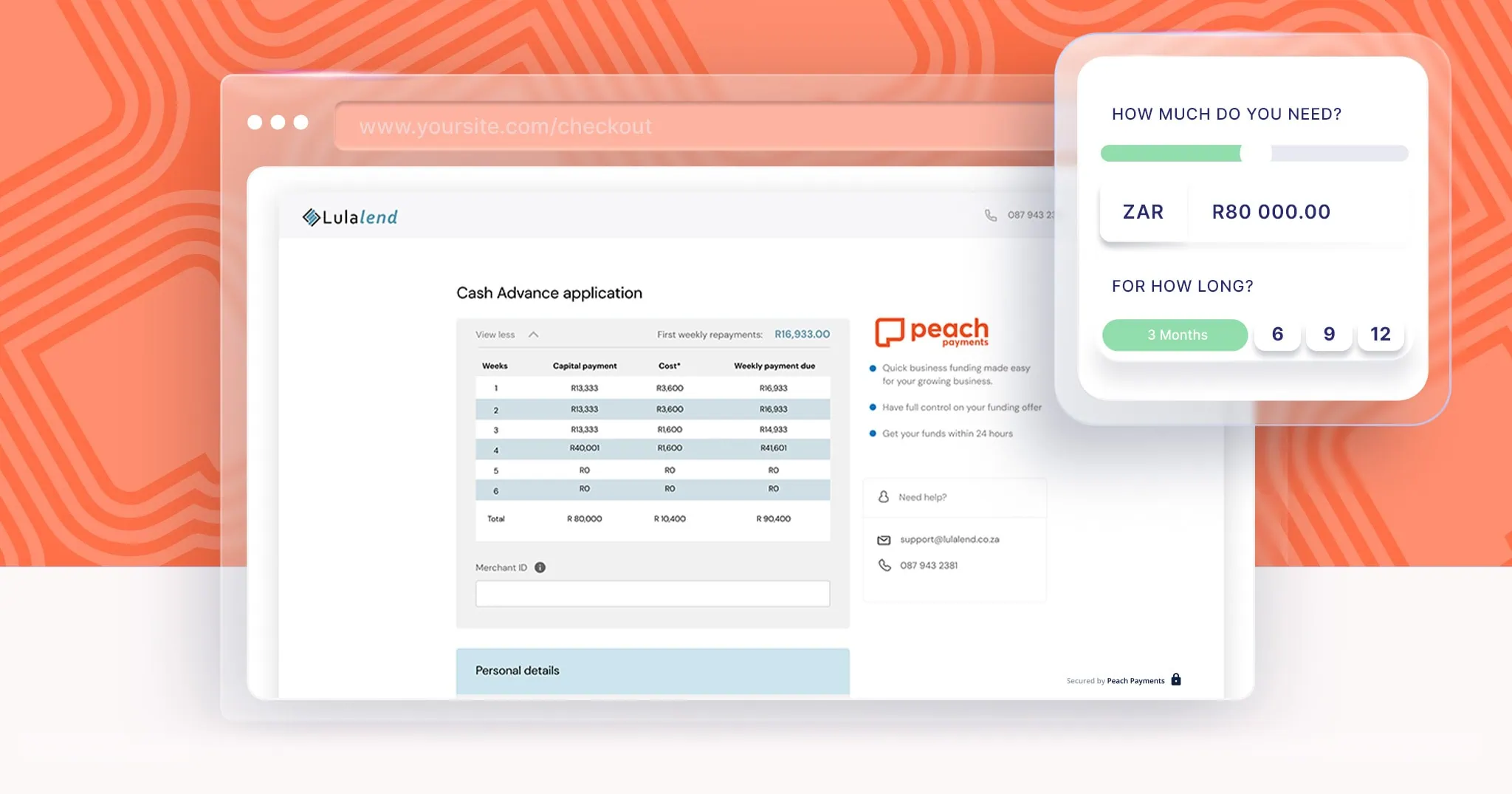

Investing in tomorrow: The benefits of business cash advance, and how to tell whether a cash advance is right for your business

In the ever-changing business landscape, business owners often find themselves at a crossroads where they need to make difficult financial decisions. An avenue that has gained popularity in recent years is a business cash advance. While some view it as a financial lifeline, others approach with caution. Here, we'll delve into business cash advances and shed light on their potential benefits while offering practical advice on how to determine whether they are the right fit for your business.

Business Cash advances have emerged as a flexible financing option, providing businesses with quick access to capital when needed most. Unlike traditional loans, cash advances offer a more streamlined application process, with minimal paperwork and faster approval times. This immediacy makes them an attractive option for businesses facing urgent financial needs, such as unexpected expenses or opportunities for growth.

One of the primary advantages of cash advances is their speed. Traditional loans can take weeks or even months to process, leaving businesses stranded in the face of time-sensitive situations. Cash advances, on the other hand, are designed for rapid deployment, ensuring that funds reach your account swiftly. This speed can be a game-changer, allowing your business to react promptly to market changes or capitalize on emerging trends.

While cash advances can serve as a valuable tool in times of need, they should be part of a broader financial strategy. Building a sustainable financial plan involves careful budgeting, strategic investment, and continuous monitoring of your business's fiscal health. Conduct a comprehensive analysis of your business's cash flow and revenue projections. Understanding your repayment capacity will help you avoid potential financial strain down the road.

Consider the purpose for which you require additional funds: Are you looking to bridge a short-term cash flow gap, invest in inventory, or seize a time-sensitive opportunity? Understanding your financial goals will help you determine whether a cash advance aligns with your immediate requirements.

While the quick infusion of capital is undoubtedly appealing, it's essential to carefully evaluate the costs and terms associated with cash advances. Take the time to understand the terms of the agreement, including any fees, and calculate the total cost of the advance. This transparency is key to ensuring that the benefits of the cash advance outweigh the associated expenses.

If your revenue tracking shows that you can expect a temporary dip in the near future due to seasonality or other factors, a cash advance can help you keep your businesses running day-to-day until revenue picks back up.

Invest a portion of your cash advance in targeted marketing campaigns to boost brand awareness and customer acquisition. This could include digital marketing efforts, social media advertising, or even the development of a new marketing strategy to reach a broader audience.

A technologically advanced business is better equipped to streamline operations and enhance customer experiences.Allocate funds to upgrade your business's technology infrastructure, whether it's enhancing your website, implementing new software systems, or improving your point-of-sale systems.

Consider using the cash advance to explore new markets or expand your physical presence: Open a new location, expand your e-commerce platform, or partner with new distributors.

Bolster your inventory to meet growing demand or take advantage of bulk purchasing discounts. A well-stocked inventory ensures you can fulfill customer orders promptly, improving customer satisfaction and loyalty.

Invest in your team by providing training programs or professional development opportunities. A well-trained and motivated workforce can significantly contribute to increased productivity and overall business success.

No spam. Just the latest news, ecommerce tips and tricks to help you scale your business.

What measures should business owners take to manage risk and fraud with ecommerce.

Read More

Understanding Dynamic Currency Conversion (DCC) and Multi-Currency Pricing (MCP)

Read More

With a focus on quality, community, and customer satisfaction, Bloomable stands out as a pioneer in the online marketplace, transforming the way local florists connect with their customers and compete in the digital landscape.

Read More

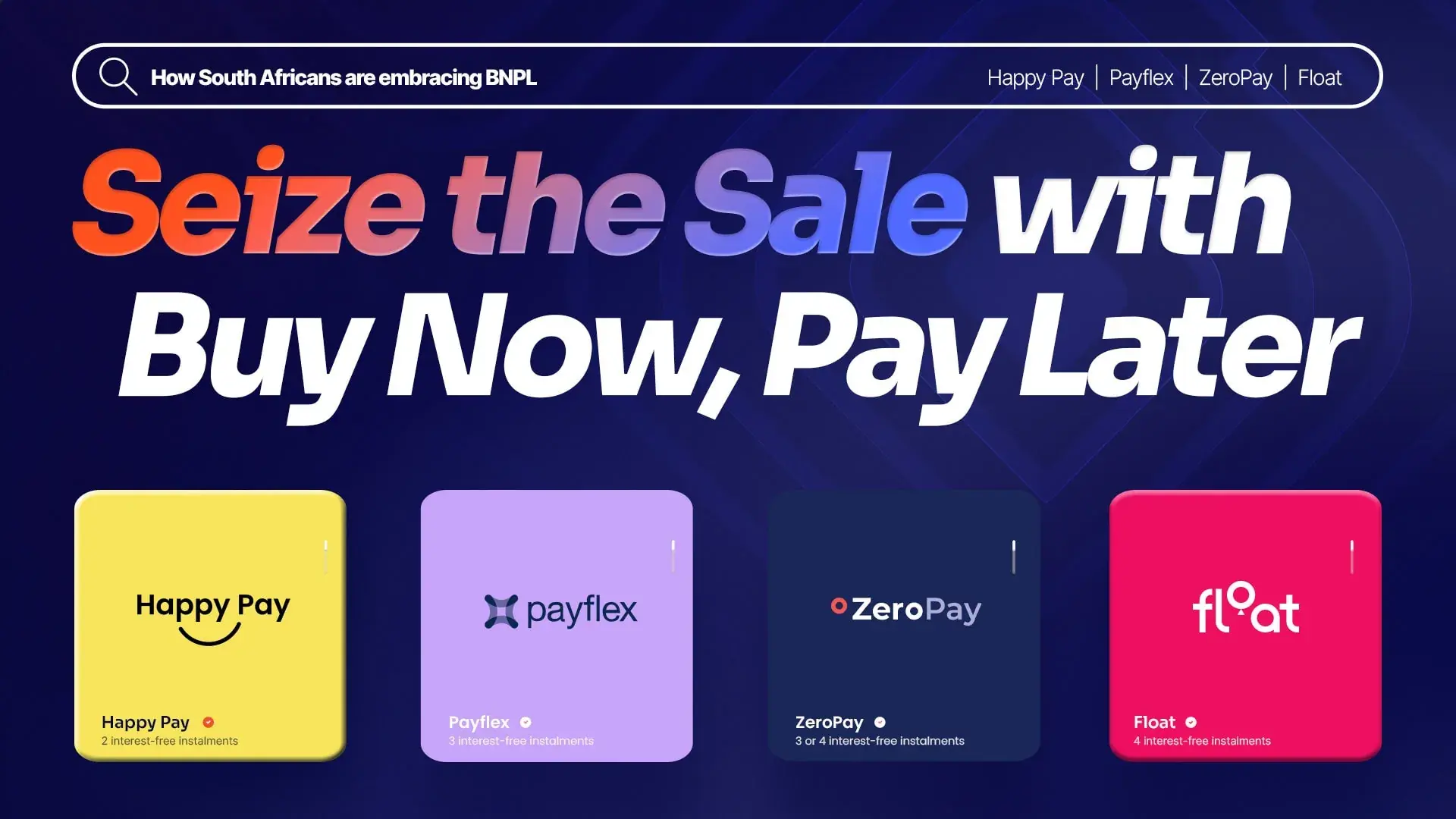

Discover how South Africans are embracing BNPL, and merchants are reaping the rewards.

Read More

Peach Payments is paving the way for a transformative 2025. From Pay by Bank to Embedded Checkout, explore how we revolutionised payments in 2024

Read More.png)

.png)

.png)

.png)

.png)