How Unmatched Support & Uptime from Peach Payments Keeps SA’s Premier Fashion Retailer on Top

The trusted African payment gateway with easy ecommerce integrations and personalised multi-channel support

The Payment Card Industry Data Security Standard (PCI DSS) is a global security framework designed to protect cardholder data and prevent fraud. The latest version, PCI DSS v4.x, introduces new requirements and updates to address evolving security threats while offering more flexibility in how businesses can achieve compliance. The deadline to reach full compliance is end March 2025.

|

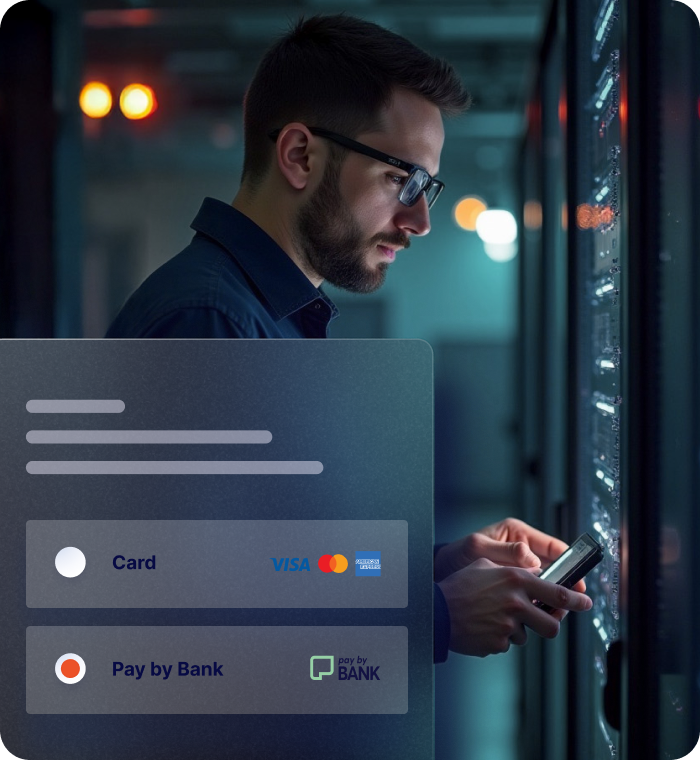

PCI DSS 4.x Compliance

Peach Payments Handles the Heavy LiftingYour trusted partner in reducing PCI scope with services and solutions designed to lighten the load: |

|

Your PCI DSS scope depends on how you handle cardholder data, and your integration method with Peach Payments plays a crucial role.

Minimise your PCI scope with basic security measures: ensure your website uses HTTPS, keep platforms and plugins up to date, and implement protections like a web application firewall. Regular monitoring and access controls further secure your environment.

Securely integrate our widget by following Peach Payments' best practices, validating inputs, and verifying source integrity. Use strong access controls with role-based permissions, and regularly review for unauthorised access. Protect against tampering with change detection mechanisms, and keep your network secure with firewalls and ongoing monitoring.

Merchants must securely store and transmit cardholder data, using encryption, tokenization, and strict access controls. Limit data storage duration and implement a robust security framework, including firewalls, intrusion detection systems, and regular vulnerability management. Conduct penetration testing to proactively identify and address potential threats.