Scaling with Peach Payments: Unveiling the Product Roadmap

Peach Payments' latest innovations and future plans, emphasising customer-centric solutions and trailblazing advancements in the African payments industry.

Read More

Peach Payments expands into six West African countries representing an exciting chapter in their journey to build a truly pan-African payment ecosystem.

Acquisition unlocks the UEMOA Francophone countries, and later CEMAC for the business

Digital payments gateway Peach Payments has agreed to acquire West-African payment platform PayDunya. In the process, it enters mainland Francophone Africa for the first time, following its expansion to Eswatini (2024), Mauritius (2021) and Kenya (2018).

Peach Payments is an enterprise-grade payments gateway that enables online payments in Africa for businesses of all sizes.

Dakar-based fintech PayDunya started operations in 2015, after Aziz Yérima realised in 2013 that there were no options to integrate online payment solutions for a women’s community group he was helping to expand online.

Francophone online payments

Yérima worked on a prototype in 2014 and co-founded PayDunya with the aim to build payment infrastructure for Francophone Africa in 2015 with fellow ESMT-Dakar students Youma Fall, Christian Palouki and Honoré Hounwanou (from Senegal, Togo and Côte d’Ivoire respectively).

Today PayDunya operates in six West African Francophone countries: Senegal, Côte d’Ivoire, Benin, Burkina Faso, Togo, and Mali. It facilitates sending and receiving payments on websites and mobile applications, as well as collection and disbursement of bulk payments. PayDunya processes payments for enterprises like Jeune Afrique, VFS Global, SUNU Assurances, Dubai Port Dakar, Sky Mali, Free business (now Yas) and other fintechs that use PayDunya’s rails.

Led by a proven team of digital entrepreneurs, PayDunya turned €20k of bootstrap financing into a profitable net income company that employs over 40 people, serves more than 4,000 B2B customers, and processes 70,000 transactions per day. With strong unit economics, PayDunya was profitable in its third year and has increased its revenues every year since inception.

Growth opportunities

The West African CFA franc is used by the eight member states of the West African Economic and Monetary Union (UEMOA): Benin, Burkina Faso, Côte d'Ivoire, Guinea-Bissau, Mali, Niger, Senegal and Togo, explains Yérima, who is also the president of SEN FINTECH, the Senegalese fintech association.

“We are thrilled to join forces with Peach Payments, a company that shares our vision of accelerating Africa's digital transformation through innovative financial solutions,” says Yérima. “This acquisition marks a significant milestone for PayDunya as it enables us to make our expansion dreams to reach and enhance the value we bring to businesses across Francophone and Anglophone Africa come true. Together, we are poised to create a seamless, inclusive, and robust payment ecosystem that empowers African businesses to thrive in the digital economy.

“The UEMOA region and neighbouring Central African Economic and Monetary Community (CEMAC) region represent a tremendous opportunity for growth, with digital payments adoption increasing rapidly due to rising smartphone penetration and mobile money services. It is early days for e-commerce and digital payments in these markets and by combining our expertise with Peach Payments’ capabilities, we are positioned to drive this growth and enable businesses to realise their full potential in the digital economy,” Yérima adds.

According to Statista, revenue in the West African ecommerce market is projected to reach US$15.33bn, with 47.7m users by 2029. User penetration is expected to hit 12.5% by 2029, and the average revenue per user is expected to be US$330.96.

Pan-African payments

“Aziz, Youma and Christian have built a market-leading business and this acquisition represents an exciting chapter in our journey to build a truly pan-African payment ecosystem. By integrating PayDunya, we are expanding our footprint into the UEMOA and CEMAC regions, unlocking new opportunities for merchants who can now partner with us and access over 450m people across the markets we operate in. Together, we can now offer seamless payment solutions across 12 countries and we will continue to expand this coverage rapidly. This makes the acquisition of PayDunya an obvious step for us, as we expand following our Series A funding round," says Peach Payments CEO and co-founder Rahul Jain.

This is the third deal Peach Payments has been involved with since late 2023, when it closed a €29m/US$30m funding round, led by the Apis Growth Fund II. In February 2024 the company acquired technology for in-store payments from Exipay and in June 2024, Peach Payments acquired customer software development firm Operativa to boost its engineering operations.

Jain says, “Peach Payments’ success wasn’t in raising the Series A Funding round. Success is in doing the hard work and expanding the business by putting that money to use. We’ve grown a lot and we are rapidly expanding into more countries.

“Peach Payments’ growth strategy is founded on three pillars: organically growing its existing market share, launching new products and services for merchants and shoppers, and using mergers and acquisitions (M&As) to facilitate growth. The PayDunya acquisition supports our expansion into West Africa, and bolsters what we are doing for cross border and international merchants.”

The deal is expected to be completed within the next few months, pending standard closing conditions and procedures.

No spam. Just the latest news, ecommerce tips and tricks to help you scale your business.

Peach Payments' latest innovations and future plans, emphasising customer-centric solutions and trailblazing advancements in the African payments industry.

Read More

Discover the impactful journey of Peach Payments innovating payment solutions over the past 12 years, and future plans to empower businesses across Africa.

Read More

A Deep Dive into the Importance of Payment Security and How Peach Payments Ensures Robust Protection.

Read More

South Africa-based digital payments platform Peach Payments shares weekend results

Read More

By partnering with Peach Payments, Digicape transformed its payment infrastructure into a strategic asset, driving significant growth, enhancing operational efficiency, and providing a better experience for their valued customers.

Read More

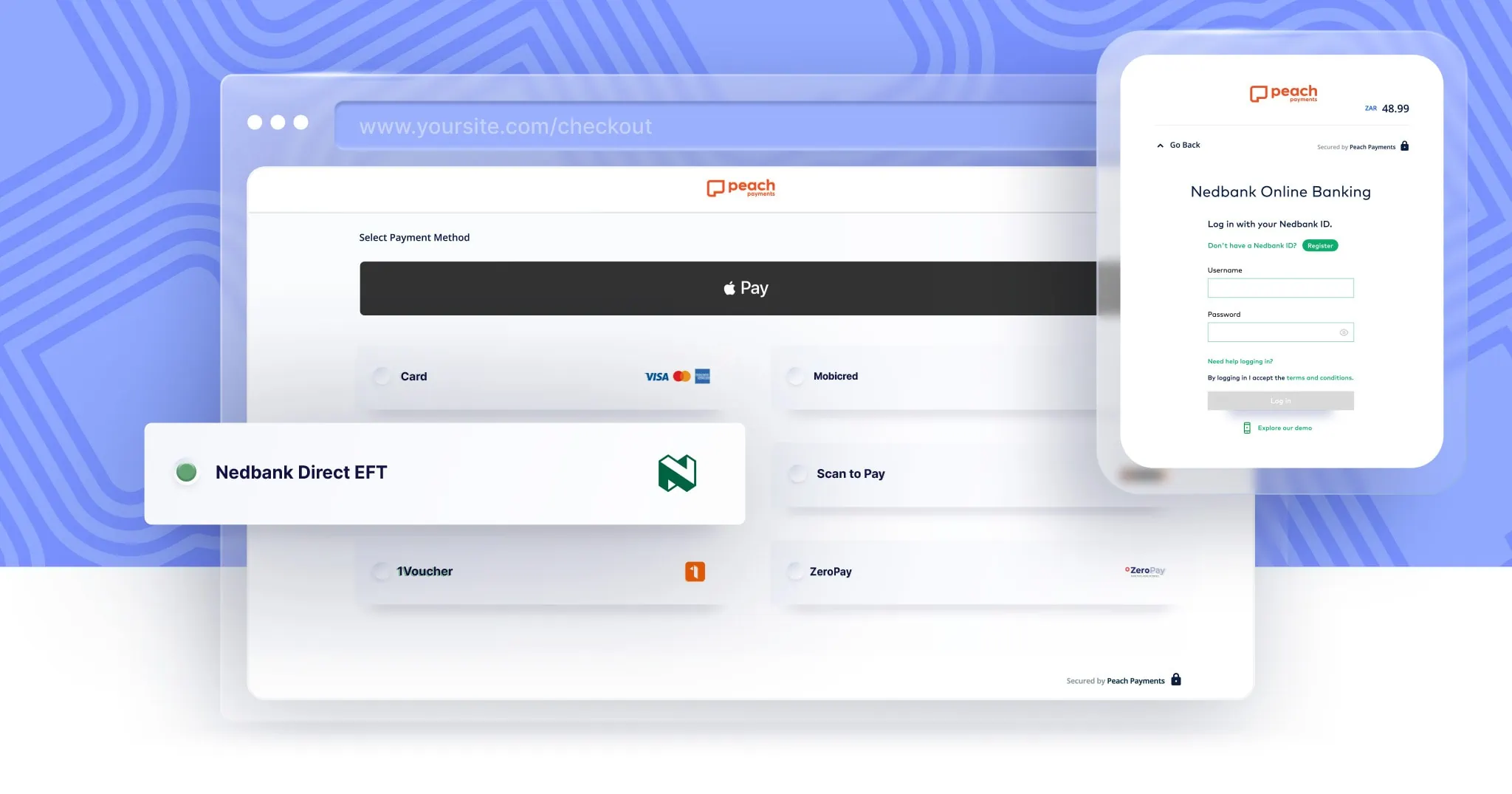

Nedbank Direct EFT is now available as a payment option on ecommerce websites that use Peach Payments, a leading South African payment gateway.

Read More.png)

.png)

.png)

.png)

.png)