Key Steps to Ensure PCI DSS v4.0 Compliance

Peach Payments does the heavy lifting, but here's what you need to do

Read More

What You Need to Know About PCI DSS 4.x

Black Friday is coming. The countdown is on, and while retailers are gearing up for the biggest sales event of the year, cybercriminals are also getting ready for their own version of a holiday bonanza. If you run an eCommerce site, it’s not just about offering irresistible deals—it's also about making sure your security measures are rock solid. This year, there's one particular acronym you should get very familiar with: PCI DSS 4.x.

Why? Because protecting your customers' data isn’t optional, especially when the stakes are this high.

Why does PCI DSS matter so much? In the simplest terms, it’s a set of stringent security standards that safeguard credit card information during online transactions. And with cyber threats evolving at breakneck speed, PCI DSS 4.x steps up the game, mandating a comprehensive approach to payment security that covers every touchpoint—from the payment form to the hosting web environment.

The message is clear: protecting your eCommerce site isn’t just about safeguarding your reputation. It’s about staying compliant and avoiding costly breaches that can devastate your business. Here’s how to get started.

Your Black Friday Security Checklist

As the digital battlefield intensifies around Black Friday, eCommerce sites must be armed to the teeth. These security practices apply to everyone, regardless of your platform:

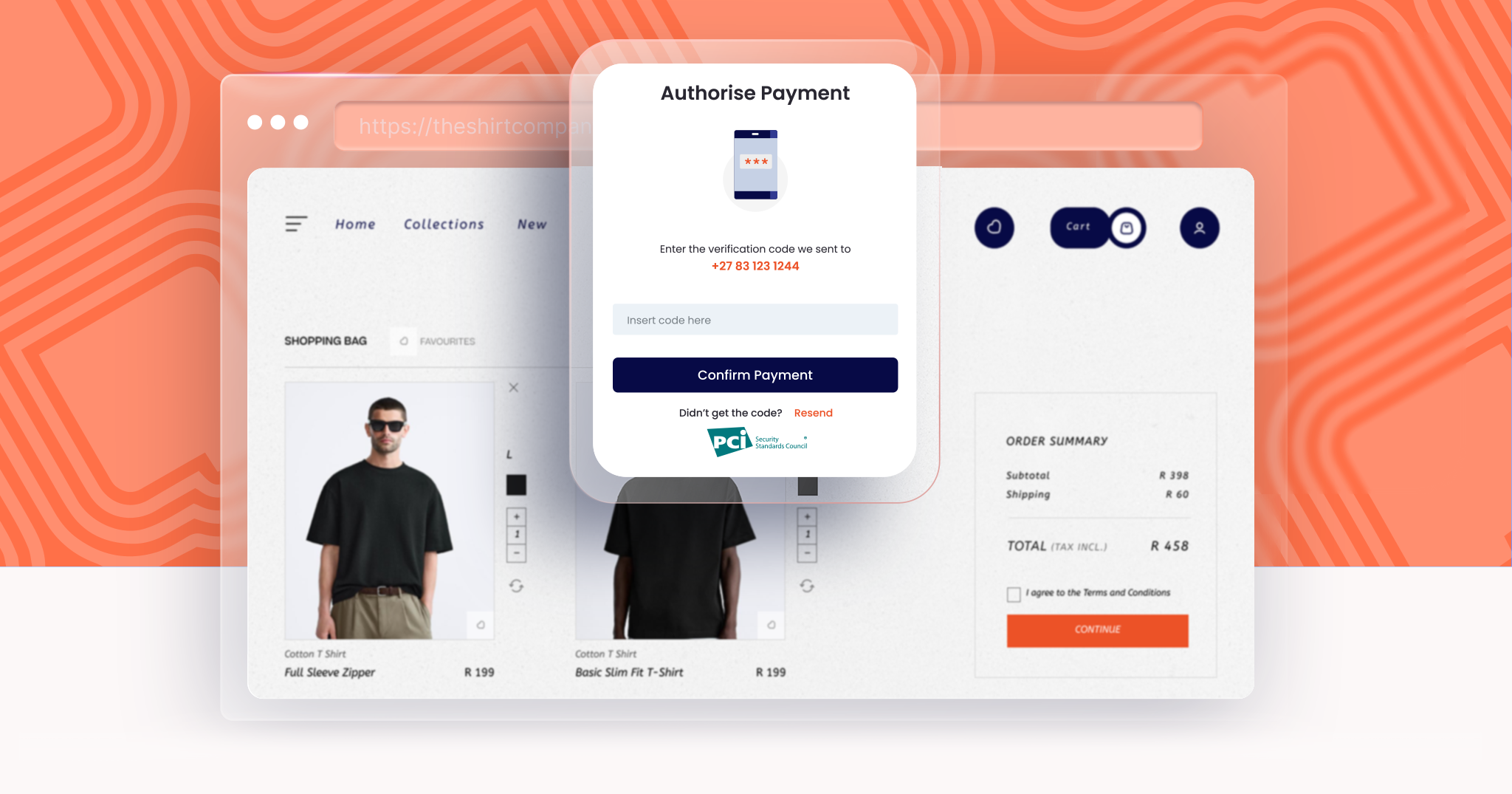

Let’s start with the basics. Weak passwords are an open invitation to hackers, so make yours as complex as possible. Use unique combinations, and don’t be shy about layering on two-factor authentication. Think of it as an extra security gate—a code from your phone or device that makes hacking significantly harder.

Think of updates as digital armor. They patch vulnerabilities and keep your site secure. Outdated software, plugins, or extensions are playgrounds for hackers, so make regular updates a non-negotiable part of your routine.

Your hosting provider is your first line of defense. Opt for one that prioritises security, offering features like firewalls, intrusion detection, and routine backups. The difference between a secure host and a cut-rate one could be your entire business.

SSL encryption isn’t just a nice-to-have; it’s essential. That little padlock icon next to your URL? It protects data like credit card information from being intercepted. If you don’t have one yet, stop everything and get it sorted.

This is where PCI DSS compliance becomes critical. Never attempt to store cardholder data on your own servers. Leave it to a PCI DSS-compliant payment gateway, which handles transactions securely and keeps you compliant with the latest standards.

What’s New with PCI DSS 4.x

Now that we’ve covered the essentials, let’s dig into what’s new with PCI DSS version 4.x. The latest update introduces future-dated requirements that become mandatory by March 2025, and these aren’t guidelines you can afford to ignore. Two of the most significant of the new and future-dated requirements include those outlined below.

Requirement 6.4.3: Inventory and Control of Payment Page Scripts

Requirement 6.4.3: Merchants must inventory all scripts running on payment pages and implement processes to detect and address unauthorized changes. It’s about stopping e-skimming in its tracks and ensuring hackers can’t slip rogue scripts onto your site.

Requirement 11.6.1: Regular Testing for Unauthorized Scripts

Requirement 11.6.1: You’ll need to regularly test for unauthorized scripts to catch any malicious activity aimed at intercepting payment data. This isn’t just an extra step; it’s an essential shield against digital theft.

Remember: These are just two of the many new requirements introduced in PCI DSS 4.x. It's crucial for merchants to familiarize themselves with the full standard and work with their payment service providers to ensure compliance.

Final Thoughts

Black Friday is a golden opportunity for your business—but also for cybercriminals. By implementing these best practices and staying ahead with PCI DSS 4.x, you can ensure that your eCommerce site isn’t just set up for sales success but fortified against the digital threats lurking in the shadows.

Remember, the future of your business is only as secure as the measures you take today. So, lock it down, get compliant, and make this Black Friday your safest—and most successful—yet.

No spam. Just the latest news, ecommerce tips and tricks to help you scale your business.

Peach Payments does the heavy lifting, but here's what you need to do

Read More

Here’s what merchants need to know about PCI DSS v4.0

Read More

RCS allows customers to make seamless online purchases with their card, enhancing the overall shopping experience

Read More

A Deep Dive into the Importance of Payment Security and How Peach Payments Ensures Robust Protection.

Read More

By partnering with Peach Payments, Digicape transformed its payment infrastructure into a strategic asset, driving significant growth, enhancing operational efficiency, and providing a better experience for their valued customers.

Read More.png)

.png)

.png)

.png)

.png)